Brand Breakdown: Winning the $390 Billion Car Insurance Search Market

Feb 27, 2024|Read time: 13 min.

Brand Breakdown

Welcome to the Brand Breakdown series, a monthly deep dive into the marketing strategies of leading global brands.

We’ll be exploring the winning, and losing, strategies that are pushing the boundaries of traditional marketing through the lens of owned asset optimization (OAO), a new approach to building consumer connection.

Subscribe today for unique insights straight to your inbox, exploring how the world’s most recognizable brands are connecting with consumers.

The direct written premiums in the US auto insurance market are projected to reach $390 billion by 2030 according to McKinsey & Company.

Companies that win auto insurance customers can grow revenue per customer even more by bundling in additional products like homeowners, life, and pet coverage. If you factor in the multi-year lifespan of an insurance customer, it’s clear why brands like Geico, State Farm, and Progressive each spend billions of marketing dollars every year to connect with new customers.

But with advancements in autonomous driving and the rapid adoption of electric vehicles, the insurance industry could be poised for change.

As insurers update policies and pricing to reflect new market conditions, consumers might shop around for new carriers. This could be an unprecedented opportunity for companies to win new business — if brands can reach customers when they’re most receptive.

Measuring the impact of brand marketing with search data

Auto insurance companies don’t sell policies and premiums. They sell promises to 215 million drivers that they’ll be there when the unexpected happens. But it takes a lot of trust to sell an intangible product that consumers hope to never use for around $2,000 per year.

That’s why brand marketing is so crucial in the insurance industry. The jingles, the taglines, and the familiar spokespeople build trust through consistency.

- ”You’re in good hands with Allstate.”

- “Like a good neighbor, State Farm is there.”

- “We are Farmers. Bum-pa-dum, bum bum bum bum!”

But how can marketers measure the impact of a billion dollars worth of brand marketing?

One answer lies in search data.

Great marketing connects with consumers. It sticks in their minds and gets woven into the fabric of social discourse. When that happens, consumers turn to Google with questions and they leave behind a trail of digital breadcrumbs.

As marketing detectives, we can analyze those breadcrumbs to see which company’s brand marketing efforts were searched most by consumers in the past 12 months.

Progressive’s marketing drives slightly more search interest overall. However, in a head-to-head match between “Jake from State Farm” and “Flo” from Progressive, Jake takes the cake. The trend really took off when State Farm introduced the new Jake in February 2020.

It’s no surprise that the auto insurance brands with the most engaging marketing are also searched more often on Google. Progressive, State Farm, Allstate, and Geico all earned more than 20 million Google searches in the past 12 months.

We can even use search data to see which auto insurance companies have the strongest employment brands by looking at how often keywords like “jobs,” “careers,” and “employment” are paired with a brand’s name.

It’s clear that brand marketing drives consumer search interest. But it’s not the only way to connect with consumers and build trust. Understanding how consumers think is crucial to influencing them at key moments along their journey.

Which questions, topics, and perspectives are important to consumers, and which companies are meeting their needs when they’re most receptive?

Understanding what auto insurance shoppers want

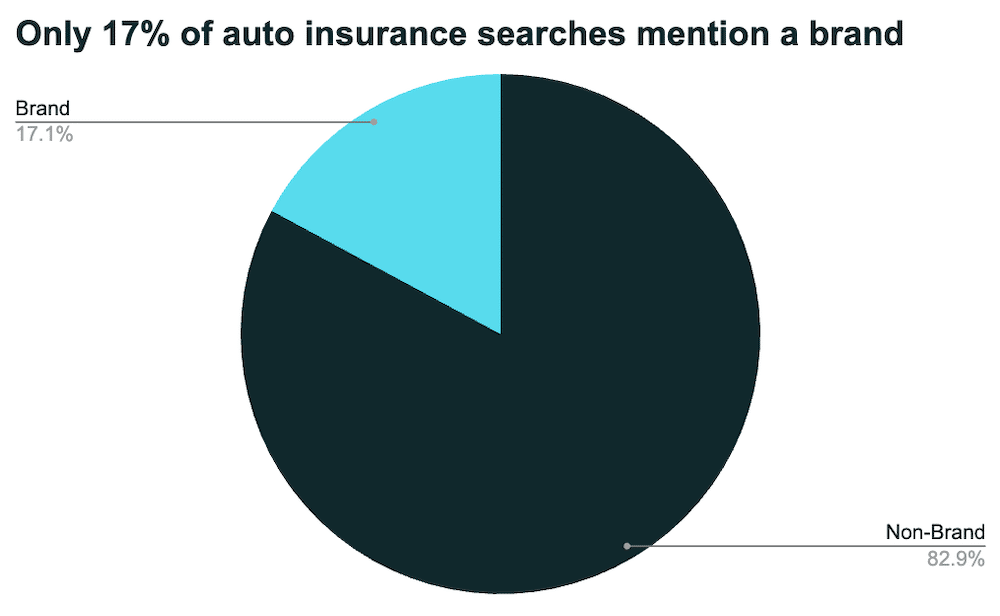

There were approximately 219 million auto insurance searches in the past year, and 83% of those searches didn’t mention a brand. That means brands have 182 million opportunities to satisfy a need, make a connection, and build trust as consumers navigate life’s changes and shop for insurance.

Although shoppers didn’t search brands by name in the non-branded category, auto insurance companies still held their ground against publishers and media brands. This year, insurance companies controlled 75% of the total search market share in the space, up from only 55% last year.

Currently, 8 of the top 10 websites in the auto insurance space are insurance companies, compared to only 5 last year. And GEICO grew its market share the most from 12% to 19%, extending its lead over competitors.

Organic search data is like having a focus group in your pocket. By segmenting searches into categories of intent, marketers can create lenses through which to view consumer needs.

Terakeet segmented the non-branded auto insurance keyword space into four categories:

- Researching

- Cost Conscious

- Local Preference

- Customized Coverage

Across all four main categories, 51% of searchers revealed that cost was important to them. This group used words like “cheap car insurance,” “car insurance quotes,” and “affordable car insurance.” This group of searchers prioritizes value.

The Cost-Conscious demographic comprises three subsegments.

- 45% of shoppers just want cheap or affordable coverage.

- 17% want to compare rates.

- 37% just want a quote.

This data gives us a window into how to reach each demographic.

Shoppers seeking cheap insurance will prioritize cost over comprehensive coverage. Those looking for a quote are likely closer to a purchase decision and might be less picky about pricing.

While shoppers looking to compare rates probably already have insurance, and they’re looking for the best value that combines high-quality coverage and affordability. This group is more likely to be window shopping and may be less committed to buying.

As expected, GEICO does well in this category because its value proposition is all about saving money on car insurance.

32% of auto insurance shoppers search broad insurance terms

32% of searchers used broad, generic keywords like “car insurance,” “car insurance agents,” and “insurance companies” while doing research. Searchers using these keywords are generally looking for auto insurance product pages rather than articles, reviews, or comparisons.

Once again, GEICO dominates this category of terms. And since searchers are looking for product pages, most of the market share here goes to insurance companies instead of publishers.

11% of auto insurance shoppers want customized coverage

This category includes search terms about the various types of coverage, such as deductibles, full coverage, comprehensive, and liability. It also includes types of drivers, like teens, new drivers, high-risk drivers, and seniors.

This group of customers may pay higher premiums to get more personalized coverage, so marketing language should target their unique needs.

In this category, Progressive is meeting consumer needs the best with its “easy guide to insurance” content hub that explains the different types of coverage and what’s best for certain drivers.

Local agents still matter

Although only 5% of insurance shoppers want a local agent, this group shouldn’t be ignored. They prefer face-to-face conversations which can build brand loyalty and result in much higher retention rates.

Farmers Insurance performs exceptionally well in this category with pages targeting states.

GEICO currently has a commanding lead, but the competition is heating up. How much is GEICO’s online market share worth in annual premium value? How did it gain so much market share in one year?

GEICO’s $300 million customer connection strategy

State Farm is by far the biggest US insurance company with $46.6 billion in direct premiums written in 2022. But GEICO and Progressive are in a close race for the silver medal.

GEICO’s persistence is powered by its strong performance in organic search where it controls 19% of the search market share in the auto insurance space. In fact, GEICO held the top position in three out of the four categories Terakeet analyzed.

GEICO consistently wins by understanding what potential customers are looking for, and creating content that meets their needs when they’re most receptive.

The brand’s content strategy includes long-form articles, product pages, comparison pages, calculators, and agent search tools. These digital assets layer on top of the company’s brand marketing efforts to establish trust through vital touch points at key moments in the journey.

Connecting with “Cost Conscious” customers

51% of car insurance shoppers are Cost Conscious, and GEICO knows it. It targets this demographic relentlessly through its brand advertising — ”15 minutes could save you 15 percent or more on car insurance” — as well as through its website.

If you’re a consumer looking to save money on car insurance, you won’t have any trouble finding GEICO’s resources in Google. The website has an entire page dedicated to “cheap auto insurance” that shows up in Google more than 14.2 million times annually.

This page isn’t just about getting a cheap quote. It’s also a resource to help shoppers understand what affects the cost of coverage, and what they can do to lower their rates. And because insurance can be hard to compare apples to apples, GEICO has plenty of other resources to help shoppers, like this page that explains how to compare rates:

GEICO also has a simple car insurance calculator tool to customize quotes. This tool alone shows up in Google for more than 3 million searches annually.

In addition to these owned assets, the brand has a library of content to help consumers save money, including types of discounts, money-saving tips, and more.

GEICO’s auto insurance page is a powerful owned asset

For shoppers just looking for some quick and simple insurance information, GEICO has them covered as well. Its auto insurance page is optimized to rank and convert, using a mix of “auto insurance” and “car insurance” terms on the page without overwhelming users with too much content.

It also mentions affordability and savings, which are key to GEICO’s target customers. The page is optimized with plenty of calls to action to capture every lead possible.

How GEICO connects with “Local Preference” customers

As we now know, shoppers who want a local insurance company could be much more brand loyal if they meet their local insurance agent face to face. GEICO does a great job of capturing searches for local auto insurance by creating unique pages by state and city.

These pages explain the types of mandatory coverage in each area, and they link to other pages discussing nearby cities. In all, GEICO has about 97 different state and city auto insurance pages that bring in about 2.2 million annual visits according to Semrush data.

Progressive pulls ahead in the “Custom Coverage” category

Progressive was the only brand to beat GEICO in one of the categories, and it pulled out a win using its massive Car Insurance Information content hub to reach consumers seeking coverage information.

The hub explains things like deductibles, liability, full coverage, comprehensive, collision, as well as insurance for teens, non-drivers, rentals, and classic cars.

GEICO’s biggest opportunity

When we analyzed consumer search data, we discovered that 214k people look into canceling their GEICO insurance each year. That’s significantly higher than all other insurance companies.

Competitors could use this insight to craft marketing messaging specifically targeting GEICO customers looking to switch carriers. If you factor in the 130k cancelation searches from Progressive, competitors could potentially capture as many as 345k new customers each year.

This insight could also give GEICO valuable data to prioritize customer experience improvements internally which could reduce churn.

Growing market share could be worth $300 million

Marketing that truly connects with consumers requires the right mix of brand and demand. These strategies work together to build trust by creating familiarity, delivering value, and maximizing touch points along the customer journey.

When these elements are in balance, brand, and demand support each other naturally, amplifying marketing impact and ROI. And this can have a massive impact on the bottom line.

Terakeet’s proprietary projections technology estimates that GEICO brings in more than $300 million each year in annual signed policies through non-branded organic search.

That means brands like State Farm, Farmers, and Nationwide could unlock over $250 million in annual recurring revenue by listening to consumers and building out their owned assets. Using an OAO strategy, they can not only unlock revenue but further insight into their customers’ needs and the online competitive landscape.