Customer Acquisition Cost (CAC): How to Calculate & Reduce It

Jun 14, 2022|Read time: 10 min.

Key Points

- Calculate your customer acquisition cost (CAC) to find ways to streamline your sales and marketing programs.

- Analyze the ratio between customer lifetime value (CLV) to and CAC to boost profitability.

- The organic search channel has low CAC and high marketing ROI, delivering strong business impact.

Customer acquisition cost is a crucial business metric that reveals your company’s financial health and guides your entire marketing strategy. When you benchmark how much you currently spend to acquire customers, you can optimize your marketing funnel and achieve a higher profit margin.

Furthermore, if you lower your acquisition cost, then you can reinvest the savings in better experiences to boost retention.

Read on to learn about what customer acquisition cost is, how to calculate it, and how it impacts marketing decisions.

What is customer acquisition cost (CAC)?

Marketing term

Customer Acquisition Cost (CAC)

Customer acquisition cost (CAC) measures the total sales and marketing cost to acquire a new customer. It’s a crucial metric that helps you compare the profitability of various marketing channels and determine your operating margins.

To understand your CAC, create a list of your sales and marketing expenses, including:

- Employee salaries

- Employee benefits

- Office expenditures

- Technology stack

- SaaS subscriptions

- Agency costs

- Contractor costs

- Ad spend

- Sales team travel expenses

- Business development costs

Then, compare this against the number of new customers during the same time period.

The CAC calculation is an important metric that helps you find inefficiencies in your customer acquisition strategy to improve profit margins.

Why is it important to measure customer acquisition cost?

It’s important to understand what potential customers are willing to pay for your products and services. However, that’s only a limited view into the health of your business. The cost of acquiring a new customer helps you more accurately understand your brand’s financial health.

For example, let’s say that you’re an enterprise software company. You look at the sales cycle, lead conversion rate, the number of new customers, and other metrics to understand your profitability. But your ability to scale the business comes down to your CAC.

A high CLV-to-CAC ratio means stronger profit margins and finances.

The less it costs you to acquire customers, the stronger your revenue model will be. And that’s great news if you need to raise capital. For example, if you operate a SaaS startup, investors will compare your brand to competitors with the same business model.

However, you should also understand the relationship between your acquisition cost and the lifetime value of your paying customers. The ratio between CAC and customer lifetime value (CLV) is a powerful indicator of your organization’s health.

High profit margins with a strong CLV-to-CAC ratio give your business greater flexibility to adapt to changing market conditions.

On the other hand, a low CLV-to-CAC ratio is a sign of pricing problems, internal bloat, or inefficient operations. If you want to be more aggressive on price to land a large new client, you most likely won’t have the leeway.

Furthermore, a poor ratio can indicate future cash flow problems that might harm the financial foundation of your business. If the ratio is negative, then you’ll need a serious financial overhaul.

How to calculate customer acquisition cost

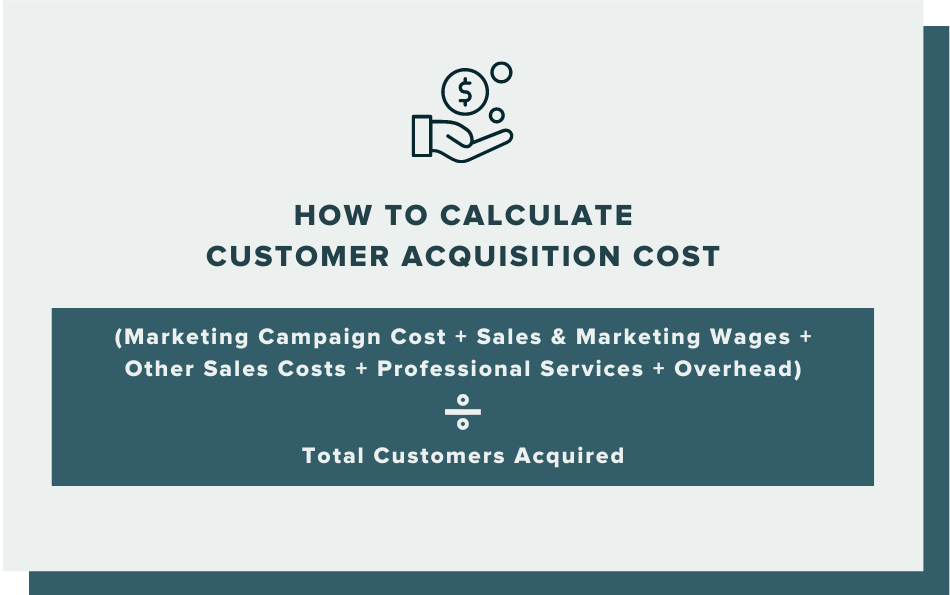

It’s actually quite simple to calculate your customer acquisition cost with the following formula:

Customer acquisition cost = Total cost of sales and marketing divided by the total number of customers acquired.

Let’s say that you spend $1,000,000 on display ads per quarter. During this time, you acquire 10,000 new customers. So, your CAC would be $100 in this case. It’s a straightforward calculation.

If you want more granular data, then use this CAC calculation instead:

You can also add other relevant sales and marketing costs to customize a formula that works for your brand.

Customer acquisition cost examples

Let’s take these numbers and put them in real-world situations.

How to calculate CAC for a SaaS company

A SaaS company hired a marketing agency to help them launch a new video storytelling tool. The agency’s fees for the marketing campaign were $10,000. Additionally, they spent $20,000 on landing pages, social media marketing, and pay-per-click advertising. The amount of money spent on internal personnel and overhead costs were $20,000. Therefore, the total marketing cost of their engagement was $50,000.

This marketing campaign brought in 250 new customers. Divide $50,000 by 250, and the total CAC is $200.

If the tool cost $50, and each new customer only used it once, then that would be a poor investment. However, what if customers subscribe to the tool for 12 months on average? Now the lifetime value of a customer is $600 which means your campaign earned 3x the initial investment.

How to calculate CAC for a Beauty Brand

A beauty brand launched a new clean makeup line. For their ecommerce marketing campaign, they hired a marketing agency to focus on media, and another agency to execute PR and influencer marketing for the 30-day blitz. The media agency charged $15,000 for services, and $100,000 for media buys and retargeting. In-store promotions cost an additional $100,000.

The PR agency charged $50,000. This included media outreach and engagements with an army of micro-influencers for the campaign. The fee for the influencers was $50,000. Although they developed the content internally, they also used an outside designer which added $5,000 to the external cost of the launch.

Multiple executives and employees from different departments were involved before and after the launch of the makeup line. Internal teams did performance analysis, reporting, and meetings post-launch. The total wages and overhead, including content development, was $60,000.

The total cost of the campaign was $380,000, and they acquired 100,000 new customers. Therefore, the CAC equaled $3.80.

Comparing CAC per digital marketing channel

To optimize your acquisition costs, compare them across digital marketing channels as well as specific marketing efforts.

To determine which channel your customer is coming from, choose your attribution model. This could be first-touch attribution or last-touch attribution. Or you can use multi-touch attribution, which is more accurate. With multi-touch attribution, you can either equally weigh each touch point or apply weighted attribution based on the influence of each individual touch point.

First-touch attribution: With first-touch attribution, the channel that acquired the customer first (often top of the funnel) gets the credit. This model can help you understand what’s driving the initial touchpoint in a conversion path.

Last-touch attribution: Which channel closed the deal? This is the last touch in an attribution model. Last-touch attribution is offered as a default on many analytics tools.

Equally weighted multi-touch attribution: In this model, assign each customer touchpoint the same cost and value. The benefit of this model is its simplicity. However, you won’t get true, accurate CAC by channel.

Weighted multi-touch attribution: This model is the most accurate. Separate each touchpoint in the conversion funnel and assign a value to each based on the individual channel’s value. If you can assess the actual value, that would be most valuable for your calculations. However, some companies rely on market mix modeling to help them assign a value to each channel, delivering a sufficient estimation.

With your attribution information in hand, here is a step-by-step approach to compare marketing channels for CAC.

1. Define the channels

First, review all trackable channels you’re using and add them to a spreadsheet. These channels may include search engine optimization (SEO), email marketing, social media, and content marketing, to name a few.

2. Determine channel expenses

Review each channel and confirm the costs. You’ll want to consider staffing, agency fees, consultant fees, tools, and advertising costs.

3. Attribute which channel acquired each customer

After deciding on your attribution model, identify the relevant channel costs based on your analytics, tracking, and customer data.

Value of Organic Search White Paper

See how an investment in organic search delivers ROI that compounds over time.

How to improve customer acquisition costs

No one has ever said, can I pay more? The same goes for CAC. There are two main ways to reduce your cost per acquisition: minimize expenditures and improve customer retention.

Reduce expenditures

One of the best ways to reduce marketing expenditures is to focus on organic channels.

Swap pay-per-click (PPC) advertising for SEO: Many brands get dazzled by the immediate results of PPC, but it’s expensive. And as soon as you stop paying for the ads, those benefits dry up. Plus, due to the costs, PPC is not a viable option at the top of the funnel.

In contrast, organic search has a long lifespan and provides compounding ROI for years instead of the length of a short-term campaign like paid media. This ultimately reduces your costs in acquiring new customers. According to Google, ROI from organic search is 5.3X compared to 2X from paid search.

According to a Terakeet-commissioned study by Forrester Consulting, customers sourced through SEO also tend to be more loyal and engaged, further reducing their long-term costs.

Lean on additional organic channels: Beyond organic search, reduce your marketing spend by turning to other organic channels. These may include content marketing, email marketing, social media, etc.

Optimize your funnel: You might have great website traffic but need to improve your ecommerce conversion rate. Analyze your site analytics to see where users exit your website. Conduct a content audit and track conversion rates. These metrics will help you optimize your conversion funnel, streamline the purchase process, and improve customer acquisition rates.

Use sales tools: If you aren’t already, add a marketing automation system to your marketing technology stack. This type of platform reveals opportunities for improvement in the customer journey. For example, you can track the ROI of your marketing channels while also streamlining your audience engagement processes.

Improve customer retention

Next, focus on reducing customer churn. On average, repeat customers spend 67% more in the third year of their relationship with a company than in earlier years. Costs of acquiring a customer are five times higher than the cost to retain an existing customer. Therefore, higher customer retention leads to increased profits.

0

%On average, repeat customers spend 67% more in the third year of their relationship with a company than in earlier years.

–invespTo reduce churn, use marketing strategies like:

- Customer feedback loops: Develop a process for regularly receiving feedback from customers. Use this feedback to improve your product.

- Increase purchase frequency and average order value: To encourage more frequent shopping, add bonuses, promote discounts, offer sales, send shopping cart emails, and nurture customers.

- Loyalty programs: Loyalty programs encourage customer retention by offering incentives.

- Customer education: Continually educate your customers, and they will get more out of your products and services. As such, they will be more likely to continue as a customer over the long term.

How customer lifetime value impacts CAC

Now that you know the importance of calculating your customer acquisition cost, measure your customer lifetime value next. The CLV (sometimes called LTV) is the total revenue produced by the average customer throughout their relationship with your brand. High CLV is a sign of financial strength and long-term stability. It typically indicates strong brand loyalty and recurring revenue.

We calculate the lifetime value of a customer in the following way:

- Define your average customer lifespan.

- Determine the average total number of purchases during the time frame.

- Calculate your brand’s average order value.

- Multiply the number of orders by the average order value during the customer lifespan.

The time period will depend on your business. For example, the CLV is calculated for certain businesses over a few months. For others, it’s calculated over years. And with other businesses, the CLV extends over decades.

Optimize customer acquisition cost

There are various ways to increase lifetime value. For example, upselling and cross-selling, subscription services, loyalty programs, or a strong customer nurture program.

CLV shows which customer segments bring the most long-term value to your business. This is important because the value goes beyond a one-time sale or campaign. In fact, your margins and CAC will continue to improve the longer your retain a customer.

Use CLV data to guide your new customer acquisition plan and intelligently allocate retention resources.

The higher your customer lifetime value, the more profit you can spend on marketing to new customers. Then, your new customer accounts will grow as well. It is a cyclical relationship.

To improve your CLV, train your customer success and customer service teams on selling tactics. They are on the front lines with your existing customers, so their interactions can influence brand loyalty, churn rates, and ultimately CAC.

The CLV to CAC ratio

Your customer lifetime value and customer acquisition costs work together to increase your profits or lower them.

To that end, examine your CLV to CAC ratio:

- Ratio less than one = Losing money on customer acquisition

- A ratio equal to one = Breaking even

- The ratio from two to five = Achieving profitability

- A ratio above five = Suggests that spending more money on marketing could improve customer acquisition results

If you track these metrics together, then you can increase profitability across your organization.

The Brand Intelligence Report

Exclusive AI insights, search trends, and brand strategies, delivered to your inbox.

Customer acquisition cost FAQs

CAC is an acronym for customer acquisition cost which measures the amount of money you need to spend to acquire a new customer.

Customer acquisition costs (CAC) is the total sales and marketing cost to acquire a new customer.

To calculate customer acquisition cost (CAC), divide the total cost of sales and marketing by the total number of customers acquired. You can calculate CAC for all of your marketing efforts, or by specific channels or audience segments.