11 Best Insurance Lead Generation Tips & Ideas

Sep 25, 2020|Read time: 14 min.

Key Points

- Insurance lead generation is the process of deploying strategies and tactics that attract potential insurance customers and fill the funnel.

- To supercharge your lead generation results, align your strategies and tactics with life stages, such as becoming a new parent, buying a first home, and retiring.

- Effective lead generation vehicles for insurance companies include SEO, content, reviews, referrals, social media, and paid search.

Insurance lead generation is about building the right funnel and filling it with water, not marbles. For instance, imagine pouring water into a funnel that’s one millimeter wide at its narrowest part. Everything flows, and your funnel works exactly as it should.

So far so good, right?

Now, imagine pouring marbles into the funnel. They won’t fit – and as the funnel grows heavy, spilling over the top is the only option the marbles have.

In a similar way, your sales funnel isn’t meant for every person in the world. Even the strongest funnels can’t do their job without qualified leads. Smart insurance lead generation strategies give you control over the success of your close rate and health of the business. They don’t just bring people into your sales funnel. They bring the right people in.

It’s the act of choosing water over marbles, then turning on the tap to unleash your lead gen growth.

How insurance lead generation builds a reliable pipeline

Unlike B2B lead generation which involves many buyers and a lengthy sales process, insurance agencies just need to connect with one or two buyers to close a deal. However, in order to make a strong connection with a new lead, agencies need to build trust.

Lead generation is not only critical for insurance companies, agents, aggregators, and partners, it also helps insurance policy seekers. The journey your customer takes on their path to purchase isn’t random. When you carefully and intentionally create each step of the journey, you build a streamlined pipeline that delivers the information your leads need at the precise times they need it.

Sales pipelines are synonymous with the conversion funnel. The widest part at the top encompasses every potential client, and parts of your audience will naturally drop off until you’re left with the narrowest portion: your high-intent, ready-to-purchase customers.

When generating leads in insurance, it’s crucial to fill the pipeline. However, as much as possible they should be targeted, quality leads. With that type of approach, your brand will generate more leads consistently that stick with you to the end. Remember the marbles?

Insurance Market Report

See which insurance brands are winning in Google.

Insurance Lead Generation Strategies

It’s important to understand the difference between demand gen vs. lead gen. Demand generation builds awareness, while lead gen drives your audience to action. I’ll cover the latter below.

1. Build an insurance lead generation website

Your insurance lead generation strategies and tactics should have a singular direction and practical goal: get people to the website. Once that’s accomplished, bring your visitors through a clean, easy to navigate, informative funnel.

Align the search intent of your audience with the right pages and content. Pair the right campaigns and offers with the right landing pages. Create content hubs that answer your audience’s questions. Make your insurance lead generation website an attractive and engaging destination where your prospective insurance customers would actually want to spend time.

Capture contact information and get more email subscribers. Provide helpful links to the related content your audience is most likely to find interesting. Intersperse CTAs at the right times, transforming your visitors into new leads.

By using your website as “command central” of your digital marketing operations, you transform your website into a lead generation machine.

2. Align buyer personas with life changes

People need insurance at all times. As insurance agents have long known, though, they especially need to prepare for and manage specific changes in their lives.

What are those life changes? As you answer that, you’ll notice different audience segments or buyer personas forming. This might include:

- Newlyweds

- New parents

- New drivers

- Parents of new drivers

- Renters

- First-time homeowners

- Home upgraders

- Moving seasonal workers

- Landlords

- Those injured on the job

- Retirees

- Etc.

As you can see, there are some unique challenges and opportunities when generating leads in insurance. Unlike a niche retail brand, insurance brands sell something everybody needs. That expands your pool of prospective leads, but it also gives you completely different audiences to target simultaneously.

Orient yourself by aligning your marketing strategies and lead generation strategies with life stages. Modify your voice for each audience, give them the right page to land on with the right content to answer the questions in their mind. Then, take them on a journey designed just for them. And be prepared to follow-up at the time of new life changes down the road.

We extensively covered customer persona examples here.

Buyer Persona Template

Build better buyer personas to meet your consumers’ needs.

3. Use SEO strategies to boost insurance lead generation

Before we dive into some of the best ways to generate insurance leads, you should know how to create an SEO strategy. If you need to brush up, skim over that post I linked to above.

Align with search intent

Search engine optimization (SEO) is one of the most powerful lead generation methods available. That’s because it doesn’t rely on cold calling or direct mail. Rather, SEO meets your audience in real-time precisely when they would benefit most. But, you don’t want just any audience. The key to filling your funnel with water, and not marbles, is understand how to determine search intent for your target keywords.

In other words, don’t do keyword research without actually thinking about the person making that search. For example:

- What worries or frustrates them?

- What do they want to find?

- Do they just need information, or are they ready to buy?

- What type of page do they expect to land on?

- Are they seeking products, or do they need a calculator?

- Do they want generic information, or specific information about your brand vs your competitors?

- Are they looking for a quick answer or something with depth?

Regardless of whether you are at a life insurance, health insurance, property insurance, auto insurance, or business insurance company, make search intent and relevance your priority. Then, pick keywords with the best SEO metrics to support that goal.

Value of Organic Search White Paper

See how an investment in organic search delivers ROI that compounds over time.

Use SEO throughout the conversion funnel

Your audience develops different needs and a deeper level of knowledge as they move down the funnel. Accordingly, they ask different questions in the search engines and look for different content. You can use SEO throughout the entire conversion funnel – awareness, consideration, decision, or retention – by targeting the searches that are made at each stage.

FYI, we wrote an entire post about full-funnel marketing here.

A person who’s in the awareness stage may not even have insurance on their mind. They might be making a broad search like “how to teach a teenager to drive”, “safe driving tips”, “how to get my teen to wear a seatbelt when driving”, or “what puts teen drivers at greatest risk of a crash”. They are looking for education. So, an infographic like this one from Hanover Insurance Group could satisfy that intent.

Once they move into the consideration phase, they’ll be actively searching for things like “car insurance for teens.” The second searcher is ready to hear your insurance pitch; the first searcher is not. There are great opportunities to resonate with your audience in each unique stage of the funnel. Make sure you capitalize on them.

4. Create a targeted content strategy

Developing intelligent content strategies is a highly effective way to target, connect, engage, and convert prospective customers. Lead generation in insurance is all about trust. And content marketing is an amazing way to earn it!

We wrote an entire post about content marketing for insurance companies.

Solve problems

The fastest way to get on a prospective customer’s radar and stay fixed in their memory is to solve problems for them. No, you don’t have to become their librarian or give them dating advice. Think about the type of problems your brand is qualified to solve and start there with your content marketing.

Moving, having kids, making a major purchase, retiring, etc. These are all monumental life events that come with a litany of questions. The last thing people want to think about is insurance, and that’s exactly where you fit in. Lighten the load by giving them jargon-free, confusion-free, clear, helpful guidance.

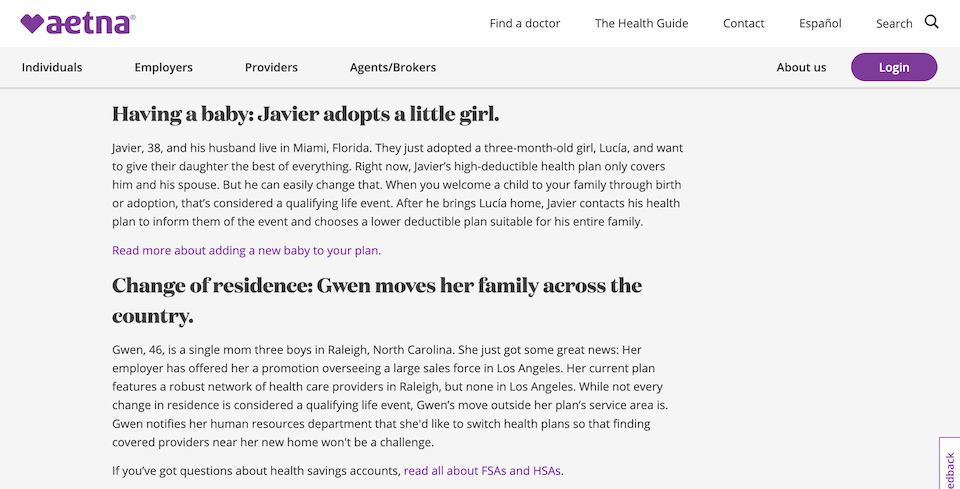

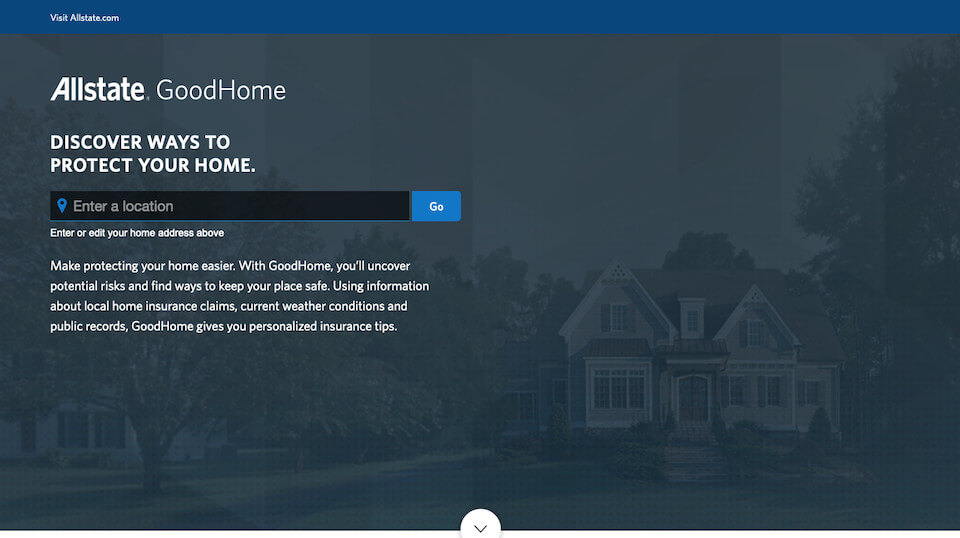

An example of content that is educational and useful while at the same time solving a problem is Allstate’s GoodHome tool. The interactive experience walks the individual through a customized assessment of risks in their own home town or a town to which they may be looking to move. It’s especially compelling due to the personalization of the information. You can get a list of risks on even a specific house in your town.

Tell stories

Problem-solving content isn’t the only way to keep insurance leads hooked. Because of your connection to major life changes, you have another powerful tool in your toolkit: stories.

Whether they’re funny and offbeat or heartwarming and tear-jerking, find the stories that capture interest and tell them. Videos, blogging, interviews, podcasts, and photo essays are all powerful ways to share a story. So powerful, in fact, that they actually change the brain’s chemistry. According to cognitive psychologist Jerome Bruner, stories are 22X more likely to be remembered than facts alone.

If you need a place to start, look no further than your own customer base. Various insurance agencies have discovered the power that the average customer story has, and they share these stories using the brand’s voice and tone. MetLife, Oscar, and USAA, for example, all showcase customer stories via a YouTube series.

Create lead magnets

When we discuss the importance of great content for insurance lead generation, we often focus on its ability to attract, engage, and leave an overall positive impression of your brand. But the right resources have a more practical function too: they’re assets. People want to read them.

Take advantage of that by gating some of your content and making it available only when the reader enters their contact information. Demand generation is a seamless way for you to bring qualified insurance leads into your funnel, and it’s a fair exchange on the user’s end.

Ideal formats for gated content include:

- Original research

- Ebooks

- Guides

- White papers

- Templates

- Courses

- Checklists, and other useful freebies

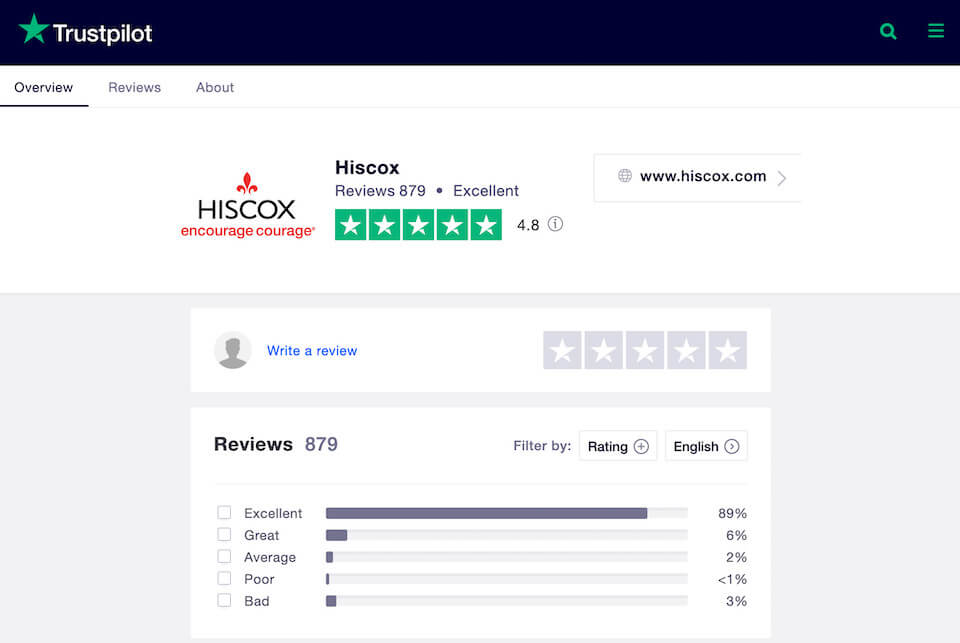

5. Get listed on review websites

One way or another, you’ll end up on review websites. The question is, who controls the narrative – you or that one unhappy customer? Claim your listings on review websites and fill out your information to completion, using the language that reflects your brand. Then actively solicit reviews from your happy customers.

You should not dictate what they say. Requesting reviews, though, will help to ensure that you balance any negativity online with a more accurate reflection of your happy customer base.

Most people will give you an online review if you ask, but the option probably won’t cross their mind without some nudging. Sadly, it’s always the unhappy customers who don’t need any encouragement to leave a review. Actively solicit reviews from the rest of your base so you can have an online reputation that reflects the whole picture. In doing so, you open up another channel for high-quality insurance leads – people often rely on review websites when they’re in the market for insurance products.

6. Build a referral engine

Your customers are connected to a whole network of people who could use insurance. In the insurance industry you can expect a certain amount of organic word-of-mouth recommendations.

However, formalizing the process gives people a much clearer reason to recommend you. Insurance agents can often play a helpful role in nudging customers to make referrals, as well.

Also, never underestimate the power of a discount! Build a referral program that rewards customers for recommending your brand by giving them financial incentive. Dynamically generated, personalized referral codes make it a piece of cake to track referrals and give due credit.

Content Strategy Playbook

The Fortune 500 CMO’s guide to content strategy.

7. Social media strategies for insurance lead generation

If you don’t think social media and insurance companies are compatible, you’ve never seen Geico’s Instagram account. For the irreverent brand, content that entertains and engages is the name of the game – even if it’s not directly related to insurance.

Take, for example, Guess That Drawing: Sloth Edition:

Or all the ridiculous antics of the GEICO Gecko:

For your insurance brand, you do not need to be funny or ridiculous to have a strong social media presence. Be authentic to your brand. That’s the most important thing.

Think about your own brand voice. Is it caring? Straight-shooting? Informative? Nerdy? Pioneering? When your content authentically reflects your brand voice, it has much more freedom when it comes to subject matter.

The key to a well-executed social media strategy is knowing which segments of your audience are on each platform. Instagram? Facebook? Twitter? LinkedIn? It may make sense to go “all in” on a few of these. Or, alternatively, to go “all in” on all of them, but in different ways aligned to each audience segment. This will help you modify your voice and hit on the topics that are important to that particular audience.

8. Paid media strategies for insurance lead generation

Because paid media and SEO strategies have benefits and drawbacks that balance each other, insurance lead generation strategies can effectively use both.

Fortunately, much of your audience research can directly inform both your SEO and paid search strategy respectively. Start with your different audience segments, and define your keywords just as you did for SEO. However, with paid search, you’ll likely want to focus on the middle and bottom of the funnel. The economics at the top of the funnel probably won’t make sense for paid search campaigns.

Just as you do for your SEO strategy, pair each keyword with the page that perfectly matches the search intent, or craft a new landing page to ensure intent is aligned. With paid search, you’ll also need to account for metrics such as cost per click.

From there, optimize. Use paid search to test out new insurance lead generation ideas and messaging. Deploy campaigns strategically to cover for certain keyword groups for which you are not yet ranking organically in Google. Remove keywords and ad groups that underperform. While we’d all love to get it exactly right the first time, the important part of paid search is the constant fine-tuning and iterating as new data rolls in.

9. Develop lead gen landing pages

One way to ensure that your page perfectly matches search intent is to develop a custom lead gen landing page made just for that keyword set.

The purpose of a custom landing page is straightforward: compel people to take action. That might be to get an insurance quote, or to request a consultation, or to sign up for a webinar or your email list.

An effective landing page uses persuasive elements like social proof, visual appeal, and customer-centricity to guide the visitor to the next step in their journey.

Give each landing page a clearly identified and trackable goal based on where the visitor will be in the funnel and the next step you’d like them to take. Then, keep optimizing the page for higher performance.

10. Optimize marketing for greater insurance lead gen results

Just like any online marketing initiatives, inbound insurance marketing requires ongoing adjustments to maximize results. If you deploy chatbots, test different messaging. When you launch new email marketing campaigns, note which subject lines have the best open rates.

The following tips are universal best practices, regardless of which type of insurance you provide.

Use CTAs

Calls to action give your audience a clear path forward. They’re an essential part of taking the next step, especially in the early stages when taking an action isn’t even on your audience’s mind yet. Use CTAs that fit the next logical course of action for the specific page’s audience.

- Where is the visitor in the funnel?

- What type of content are they looking at?

- What subjects do they appear to be interested in?

If your visitor is somewhere between funnel stages, which is often the case, intersperse different calls to action at appropriate places on the page and let them decide which action to take. For example, provide them with a path to videos about happy customers, while also offering links to related posts, and giving them the option to get a quote immediately.

Implement A/B tests

Still on the fence about your CTAs? The wonderful thing about A/B testing is that you don’t have to guess at user preferences. Not when it comes to CTAs or any other design or content change you’d like to explore. You can A/B test elements such as:

- Content of CTA

- CTA size, style, and color

- Location of CTA

- Offers and messages

- Benefits described

- Headlines

- Page layout

- Individual design elements

- Video vs. image

- Text length

- Types of social proof

- Etc.

The sky’s the limit. Working with one element at a time, test different versions against each other and move forward with the winner.

Ready to set the bar higher? Use the winner as your new control and try to beat it with a new experiment. Rinse and repeat, and rinse and repeat.

11. Analyze and optimize

Take advantage of all the data you have at your disposal and watch it like a hawk. Optimize your pipeline to increase your insurance sales. Notice which campaigns, pages, blog posts, social posts, ads, and offers are have the highest conversion rates. Notice which ones don’t.

Your data will help you refine your strategy, and the path will only grow clearer over time. Performance metrics are essential, but remember that at the root, your data is a learning tool. Use it as such and you’ll send your number of qualified insurance leads soaring.