Responding to RSV: How Pharma Brands Can Help 131 Million People

Mar 29, 2024|Read time: 14 min.

Brand Breakdown

Welcome to the Brand Breakdown series, a monthly deep dive into the marketing strategies of leading global brands.

We’ll be exploring the winning, and losing, strategies that are pushing the boundaries of traditional marketing through the lens of owned asset optimization (OAO), a new approach to building consumer connection.

Subscribe today for unique insights straight to your inbox, exploring how the world’s most recognizable brands are connecting with consumers.

Based on demographics and vaccination rates, the demand for RSV immunizations in the U.S. could eventually exceed $19 billion. But beyond the numbers lies an opportunity for pharmaceutical companies to become an essential resource for consumers and drive positive health outcomes.

With only a few immunization options currently approved by the FDA, pharmaceutical giants like Pfizer, GSK, Sanofi, and Sobi are fiercely competing for market dominance. And new competitors like Moderna are also preparing to enter the market.

But it won’t be easy to differentiate.

When patients are immunized, they aren’t exposed to product packaging or brand names. All they see is a generic syringe. In fact, 80% of consumers take drugs without considering the manufacturer.

How can pharmaceutical companies overcome these challenges to authentically connect with consumers, strengthen brand awareness, and have a greater impact on public health?

131 million

RSV doesn’t affect everyone equally. It’s most dangerous to people with weaker immune systems, including babies, pregnant women, and the elderly. While the total addressable market (TAM) may be smaller compared to the flu shot, the potential for positive impact remains substantial.

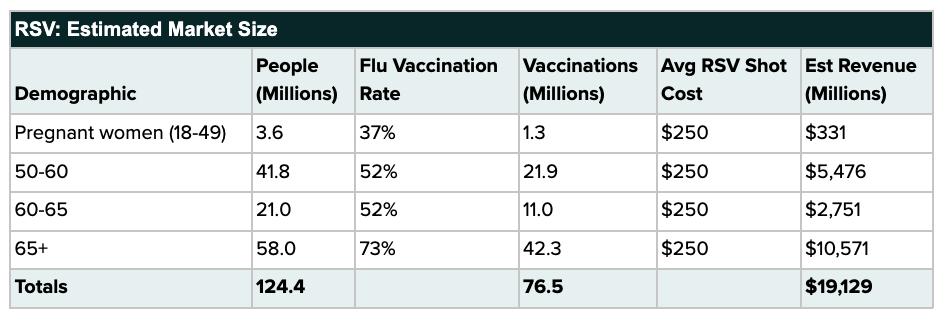

Pfizer’s Abrysvo caters to various age groups with distinct needs and is recommended for pregnant women to immunize babies before birth, as well as adults over 60. (Note: The FDA may expand its recommendation to include adults over 50, so we’ll use that expanded age range in our estimates). This gives Pfizer the largest TAM of about 124.4 million people.

GSK’s Arexvy also has a massive opportunity to reach roughly 120.8 million, slightly lower than Pfizer because it’s not approved for use during pregnancy.

Two pharmaceutical brands, Sanofi and Sobi, offer monoclonal antibody treatments approved only for the 7 million U.S. children under 2 years old, prioritizing the well-being of our communities’ youngest members.

Improving vaccination rates in the $19 billion RSV market

The flu vaccine has been widely available in the U.S. since 1945, giving us access to decades of data about immunization rates. RSV vaccines were only approved in 2023, so we’ll need to rely on flu vaccination rates to estimate total potential demand for (and economic impact of) RSV vaccinations.

Although these two viruses are different, they both have a greater impact on vulnerable populations and draw similar seasonal demand according to search data from Google Trends.

If we combine population and vaccination data from the CDC and Statista, the total potential reach of RSV vaccinations in the U.S. comes into focus. And, if we factor in the average cost per dose based on the CDC’s vaccine price list, we can estimate the economic impact per age segment, as well as the overall financial implications at full adoption.

If we exclude the 50 to 60 demographic, the total reach would equate to about $13.6 billion. If the FDA approves RSV vaccination for that age group, it could unlock an additional $5.5 billion, bringing the total to $19.1 billion in economic impact.

As promising as this data looks, it’s just a snapshot of one possible future if pharmaceutical brands invest in growing RSV awareness.

Currently, demand is particularly low among seniors. Although 73% of seniors get a flu shot, only about 15% opted for RSV vaccination in 2023.

To increase vaccination rates, brands like Pfizer and GSK must educate consumers about risks, symptoms, and prevention with brand marketing and physician education via owned asset optimization.

Which RSV topics are consumers most concerned about? Which brands are helping people most throughout the customer journey?

Meeting consumer needs in RSV

In the past 12 months, more than 41 million Americans have searched for information related to RSV. Each of those searches represents an opportunity for pharmaceutical brands to help someone live a healthier, longer life.

By sifting through that search data, brands can learn what matters most to consumers and how to reach them when they’re most receptive.

Terakeet analyzed and grouped those 41 million searches into the following categories based on search intent:

- RSV information

- RSV symptoms

- RSV diagnosis

- RSV treatment

The category with the most searches was “RSV information,” showing that consumer awareness about RSV is rapidly increasing.

As more people learn about the benefits of RSV immunization over the next few years, search interest is likely to shift from general information to treatment and prevention.

If we compare the branded vs. non-branded segments of RSV searches, we can start to see the connection challenge pharmaceutical companies face: Only 3.3% of all RSV-related searches mention a brand or drug by name.

Above, we revealed that Pfizer and GSK each have access to 10 times as many potential customers as either Sanofi or Sobi. So you might expect the branded search distribution to follow the same ratio.

But that’s not the case.

The data reflects a massive opportunity for both Pfizer and GSK to grow brand awareness within the RSV vaccine market.

Which brands are connecting?

The best way to determine which brands are meeting consumers in their moments of need is by analyzing organic search market share. This metric measures which websites earn the most potential clicks out of the total available clicks based on search volume and ranking position.

Using Terakeet’s proprietary software, we determined the organic search market share across all 41 million RSV-related queries, as well as for each of the four categories. We also classified each of the top 20 websites as either a brand (sells goods or services) or a publisher (creates content and resources). This enabled us to determine how much influence brands have over consumer decisions in the RSV space.

At a high level, publishers owned nearly 70% of the organic search market share across all RSV-related queries.

Among the top 10 websites, seven were publishers. And the only brands that showed up were healthcare providers.

If we flip that graph on its side, we can expand it to show the top 100 websites by market share. Doing this reveals how only a handful of websites dominate the search landscape.

Shockingly, no pharmaceutical brands made the top 50 market shareholders, and only six of the top 100 websites were controlled by pharmaceutical companies.

Walmart and CVS show up for “RSV treatment” topics

The “RSV treatment” category contains searches specific to RSV vaccines, as well as symptom-specific treatment searches, like “baby cough medicine.” In this category, nearly 60% of searchers were looking for information about vaccines and immunization.

Although retail giants CVS and Walmart made the top 10 in this category because they sell children’s cough medicine, the two biggest market share holders were the CDC and the FDA.

The American Lung Association dominates the “RSV symptoms” category

Although the CDC has the most organic search market share overall, the American Lung Association pulled ahead in the symptoms category. As an expert on lung health, the organization helps consumers understand what could be causing their symptoms.

How did the American Lung Association outperform the CDC in this category? And how did it grow its overall reach in the RSV space from 4.6% last year to 12% this year?

Learning from the American Lung Association

Pfizer’s ambition isn’t to “make $1 billion.” It’s to “change a billion lives a year.” Similarly, GSK aims to “positively impact the health of 2.5 billion people by the end of the decade.”

In other words, pharmaceutical companies are driven by the desire to help people live longer, healthier, and more meaningful lives. The medical breakthroughs they’ve developed have done just that.

But there’s an incredible opportunity to pursue that purpose more boldly and authentically by meeting consumers in their moments of need — long before they seek treatment.

Being there for patients when they’re seeking information is vital for building brand awareness, trust, and loyalty. It’s one of the many reasons the American Lung Association grew its market share from 4.6% to 12% in one year.

Prioritizing education and advocacy through content

The American Lung Association’s mission is “to save lives by improving lung health and preventing lung disease” through “education, advocacy, and research.” With education and advocacy in its purpose, the organization enables investments that amplify its mission of expanding awareness.

While pharmaceutical companies tend to prioritize treatment to impact lives, the American Lung Association prioritizes awareness. To accomplish this, it publishes an extensive library of RSV content, including a resource hub, blog posts, and videos to inform and engage consumers.

But it doesn’t have to be an either/or decision.

Pharmaceutical companies could invest in both brand awareness and disease awareness by publishing helpful content that answers important questions about symptoms, treatment, and prevention.

In fact, several pharmaceutical brands are already doing this. Websites like rsvandme.com, rsvuncovered.com, and knowingrsv.com are all owned by pharmaceutical companies and inform consumers about RSV.

However, they’re just microsites with a few pages each rather than a rich library of content and resources designed to impact lives, tell stories, and guide decisions.

Connecting with RSV information seekers

Unlike the pharmaceutical companies, the American Lung Association (lung.org) offers a well-organized content hub to educate consumers seeking general information about what RSV is and who’s most at risk. The main page of the hub defines what RSV is and links out to more specific questions about the virus.

Within the RSV knowledge hub, consumers find key facts, statistics about hospitalizations and deaths, and videos about causes and risk factors.

The hub even has an index page to help consumers browse its extensive library of videos and resources.

Helping consumers understand RSV symptoms

The American Lung Association grew its organic search market share the most in the “RSV symptoms” category. In one year, it exploded from 5% to 26%, reaching about 2.1 million consumers annually with symptoms-related content.

Informing consumers about treatment and immunization

When consumers understand RSV risk factors and symptoms, they’ll feel more ready to explore treatment and prevention. Building trust along this entire learning journey is vital in the health space.

The American Lung Association explains treatment and prevention options through multiple videos as well as text content within its RSV learning hub. They give advice about immunizations, everyday prevention actions, and treatment to expect during hospitalization.

Source: lung.org

In addition, they publish multiple blog posts tagged with “RSV” that provide tips, advice, and firsthand experiences. These articles are highly valuable because they give readers peace of mind knowing others have been through this.

Brands can help close gaps in patient education and action

The American Lung Association’s RSV content library is vast and thorough, but there are opportunities to improve. For example, cdc.gov has more content about how RSV affects older adults, including an “RSV for seniors” overview page and a detailed FAQ page.

The CDC website also provides printable infographics and vaccination information. These resources help older adults understand the risks and prevention options that are most relevant to them without overwhelming them with irrelevant information about other demographic groups.

Seniors are a critical demographic to help because they represent the largest pool in need, have the highest risk of severe complications, and have a low vaccination rate compared to the flu.

With marketing budgets in the billions of dollars, pharmaceutical brands are well positioned to invest in large-scale initiatives to educate and empower these unreached consumers. Most importantly, these efforts could significantly improve RSV vaccination rates among pregnant women and the elderly.