Winning the $2.9B Battle for Undecided Insurance Customers

Mar 12, 2025|Read time: 8 min.

Key Points

- The non-brand organic search market for insurance is valued at $2.9 billion. If one company wins across the top five insurance categories it could generate $500 million in annual premiums.

- 53% of insurance searches don’t mention a brand. This highlights a massive opportunity to reach undecided shoppers seeking insurance information when they’re most receptive.

- In January 2025, non-brand insurance search interest reached record highs. The companies with the most organic search market share were best positioned to meet consumer demand.

The battle for undecided insurance customers is increasingly being fought — and won — through organic search.

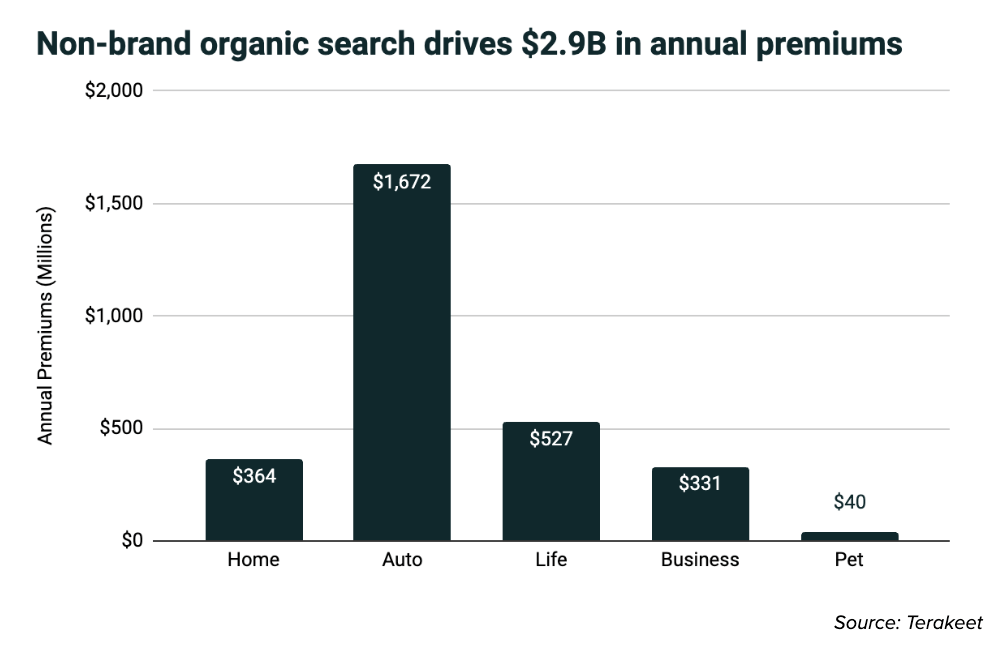

In 2024, only 47% of insurance-related queries included a brand name. This highlights a massive opportunity to connect with customers who haven’t made up their minds yet. Terakeet estimates the non-brand organic search market for insurance is valued at $2.9 billion in annual premiums across the top five categories.

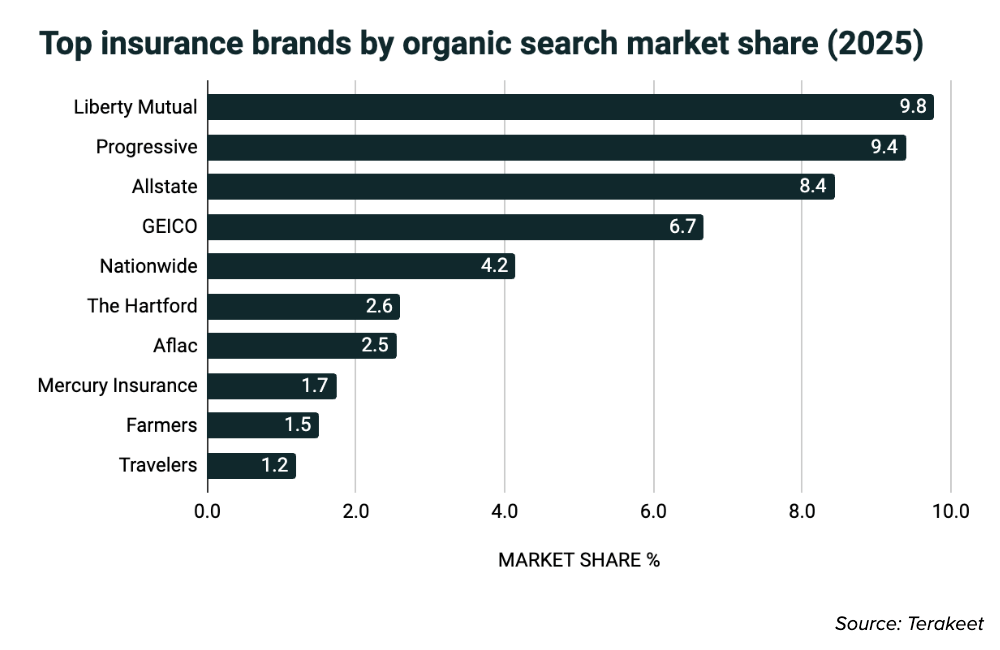

Winners like Liberty Mutual, Progressive, Allstate, GEICO, and Nationwide are gaining hundreds of millions of top-line dollars from their investment in organic search, while brands like State Farm, Travelers, Farmers, and The General leave low-hanging fruit on the table.

This report reveals key insights about how consumers search, how the market shifted over the past year, and what marketing leaders can do about it.

For more insights about consumer needs and market performance, explore our library of Brand Breakdown articles.

How consumers search for insurance

Millions of potential customers reveal exactly what they want every time they type a question into the Google search bar. By decoding these digital breadcrumbs we gain insight into consumer needs and the competitive landscape. With that, we can make more strategic marketing investments.

Understanding unbranded search behavior

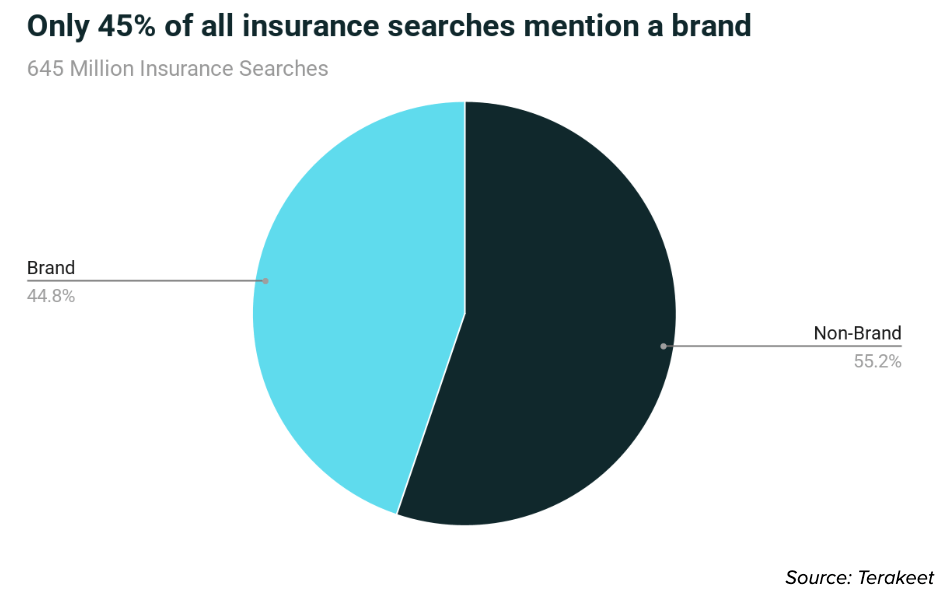

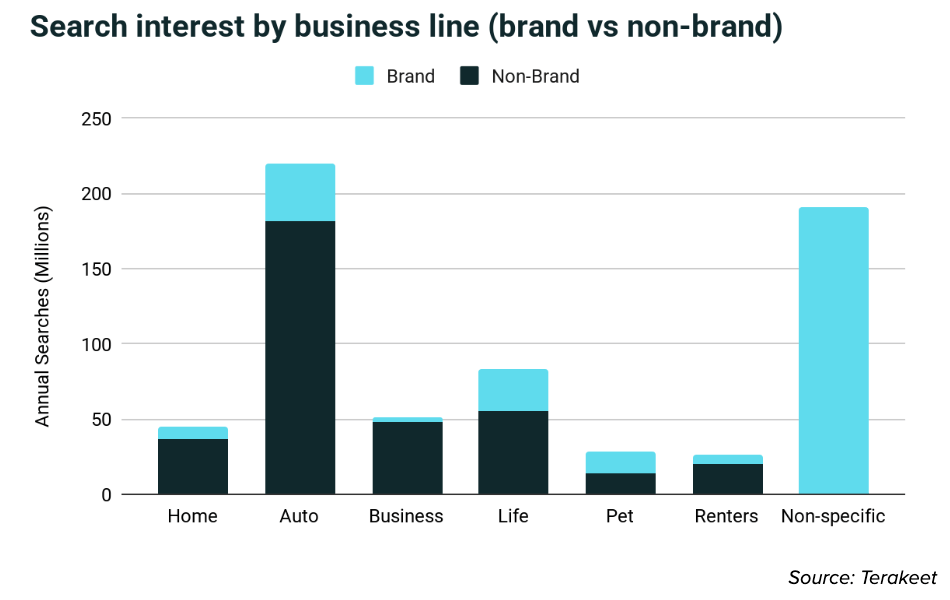

Despite insurance companies spending billions of dollars each year on brand marketing, only 45% of insurance searches mention a brand.

That may seem like a fairly even split. However, when we segment the data by business category, we learn that most branded searches are generic, like “State Farm” or “Progressive insurance.”

When consumers search for certain types of insurance, brands are rarely top of mind. In fact, 94% of business insurance searches, 83% of auto insurance searches, and 82% of home insurance searches do not include a brand name. This reveals an untapped opportunity for companies to win undecided customers in these segments.

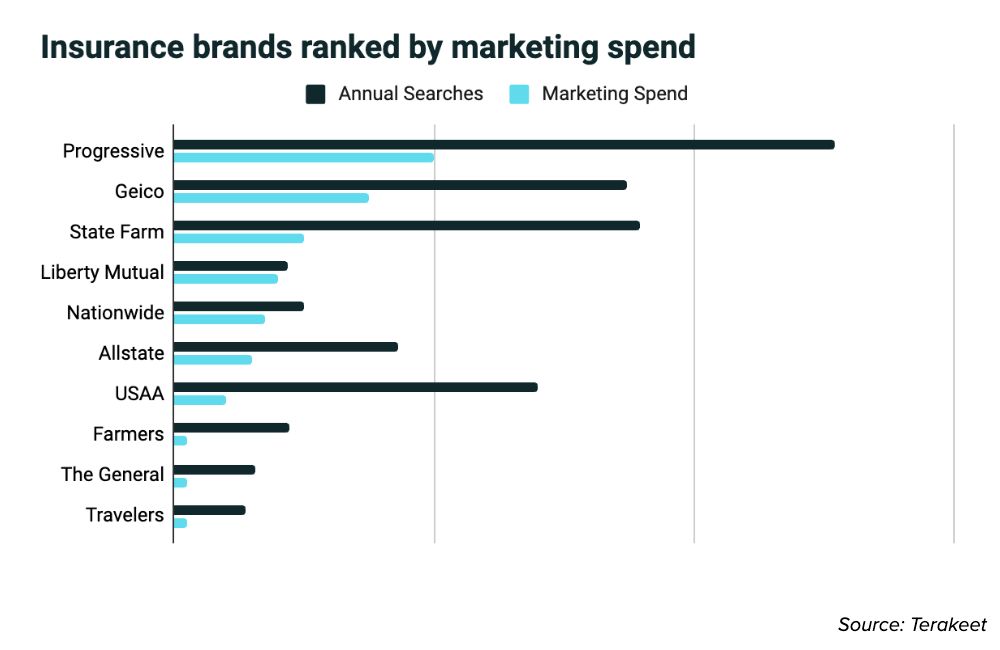

Brand marketing obviously plays an important role in the customer journey. The companies that spend the most on marketing are also searched most often. And brand searches tend to convert into customers at a higher rate than searches without a brand name.

But overinvesting in brand marketing can have diminishing returns while also siphoning budget away from vital performance marketing channels.

Consumer priorities vary by insurance category

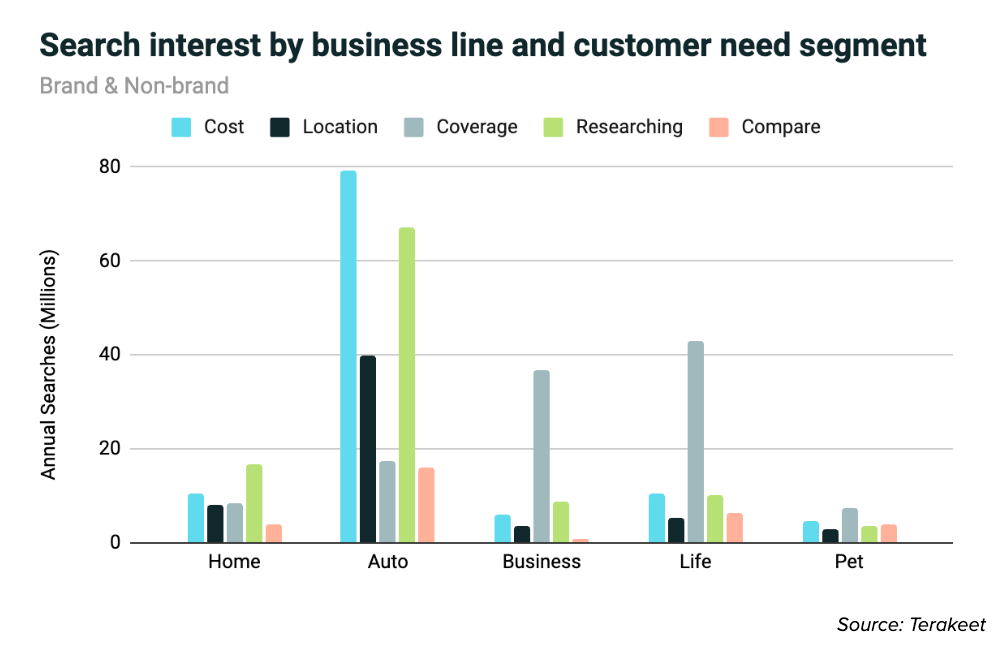

You might expect consumer needs to remain consistent across all insurance categories. For example, if cost is important to 25% of auto insurance buyers, shouldn’t it be equally important to home insurance shoppers?

According to the data, the answer is no.

Auto insurance shoppers are more cost-conscious than any other type of insurance seeker. They often prioritize affordability over coverage, location, or value.

On the other hand, consumers searching for business and life insurance are more concerned with coverage. Business owners want insurance from a provider that understands their industry — construction, hospitality, medical, beauty, etc. And people shopping for life insurance want to know whether whole or term is the best option for them.

Understanding how consumer needs differ from one product to another helps you fine-tune your go-to-market strategy and emphasize what matters most to each type of customer.

It’s also important to understand how well your brand performs in organic search for each of these need segments.

If you have a strong local agent network, then you’ll want to dominate organic search market share among consumers searching for insurance by location. Or if your business model is designed around cheap insurance, you should be highly visible for searches about low-cost, cheap, or affordable insurance.

Search trends reinforce the power of non-branded market share

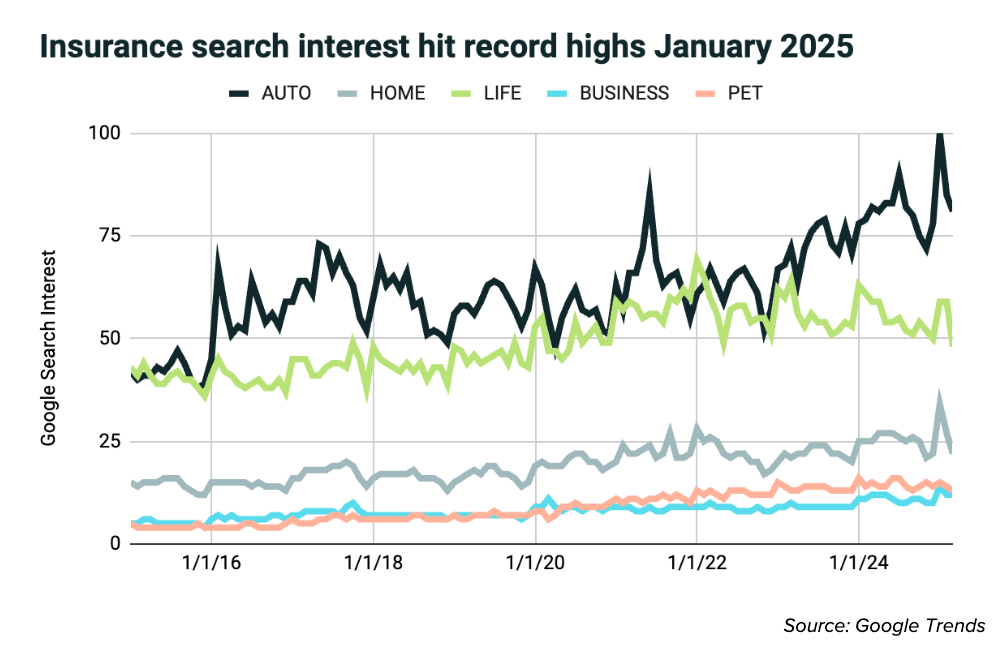

Search behavior isn’t static — it fluctuates based on external events. One of the most striking shifts in the last 12 months was a record high in auto and home insurance search demand that peaked in January 2025.

This surge was likely influenced by the California wildfires, which forced thousands of consumers to reevaluate their coverage. When consumers face sudden disruptions like policy cancellations, premium hikes, or dissatisfaction with providers they turn to search for solutions.

Insurance companies that dominated non-branded searches during this period had a decisive competitive advantage to meet in-market consumers in their moments of need.

Let’s see which brands were winning across key insurance segments over the past year.

Insurance Market Report

See which insurance brands are winning in Google.

Winners and losers in organic search market share

Organic search is one of the few marketing channels that delivers both brand and performance outcomes. It’s an always-on acquisition channel that drives leads predictably and cost-effectively while also building brand awareness, affinity, and trust with future customers.

But organic search is a zero-sum game. For one brand to win, others must lose. And the brands at the top capture significantly more market opportunity than those at the bottom.

Insurance brands gained ground as affiliates weakened

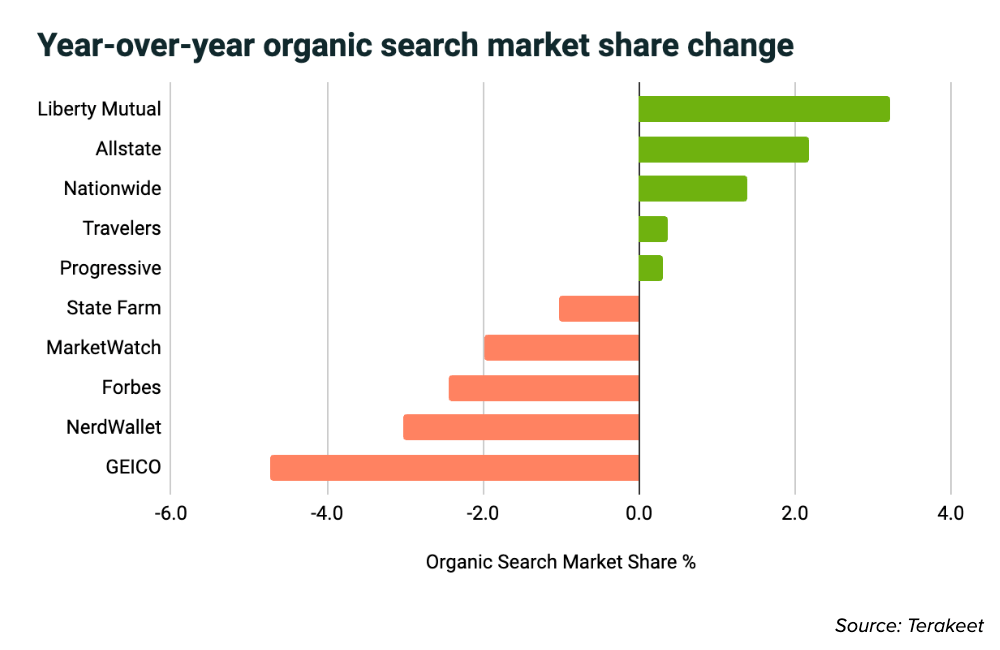

Affiliate websites (like NerdWallet, Forbes, and MarketWatch) lost search market share over the past year as Google refined its algorithm. As of January 2025, affiliates collectively controlled only 16% of organic search market share across the insurance space, a decline of nine percentage points over the prior year.

Insurance brands took advantage of this weakness, reclaiming direct visibility in high-intent searches. These gains are important because they allow insurance companies to control their own brand narratives and influence purchase decisions.

When affiliates control the field, they send valuable traffic to competitors, amplify unfavorable narratives, and charge high referral fees.

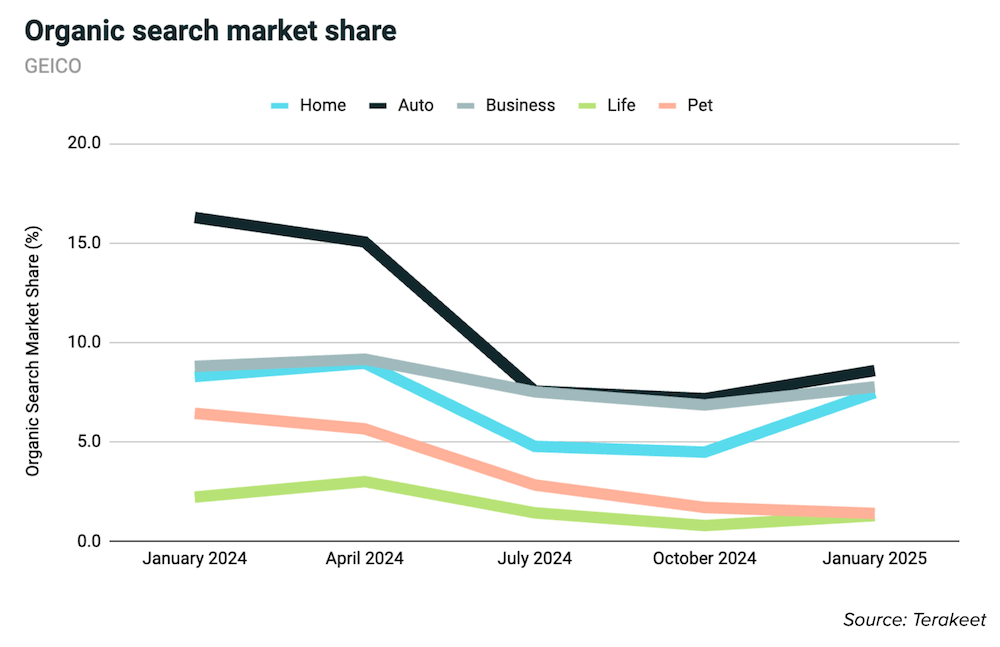

GEICO was dethroned as the market leader

While the winning insurance brands gobbled up non-brand organic market share from freefalling affiliates, GEICO lost ground in all five categories, dropping 4.7 percentage points overall.

The website was hit particularly hard in auto insurance — a category it once dominated — but now struggles in fourth place.

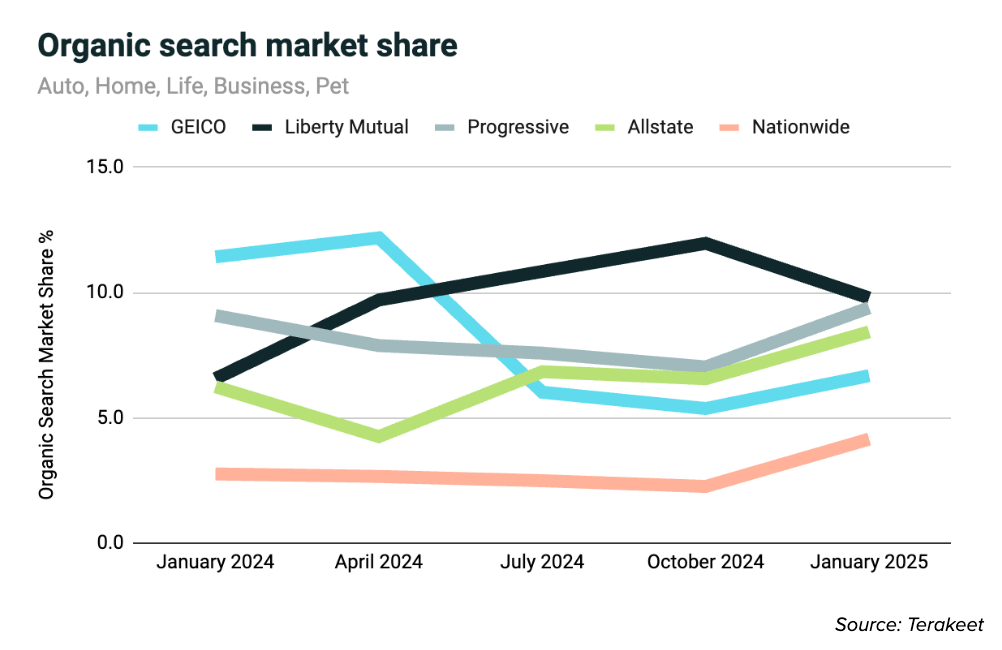

Competition tightened in a volatile market

Market share volatility was the dominant theme for 2024. The competitive landscape shifted considerably in Q3 before tightening by the end of the year. This was likely due to affiliates shedding market share which multiple insurance brands then absorbed.

Liberty Mutual had the strongest run, surging to a commanding lead before closing the year in a dead heat with Progressive and Allstate.

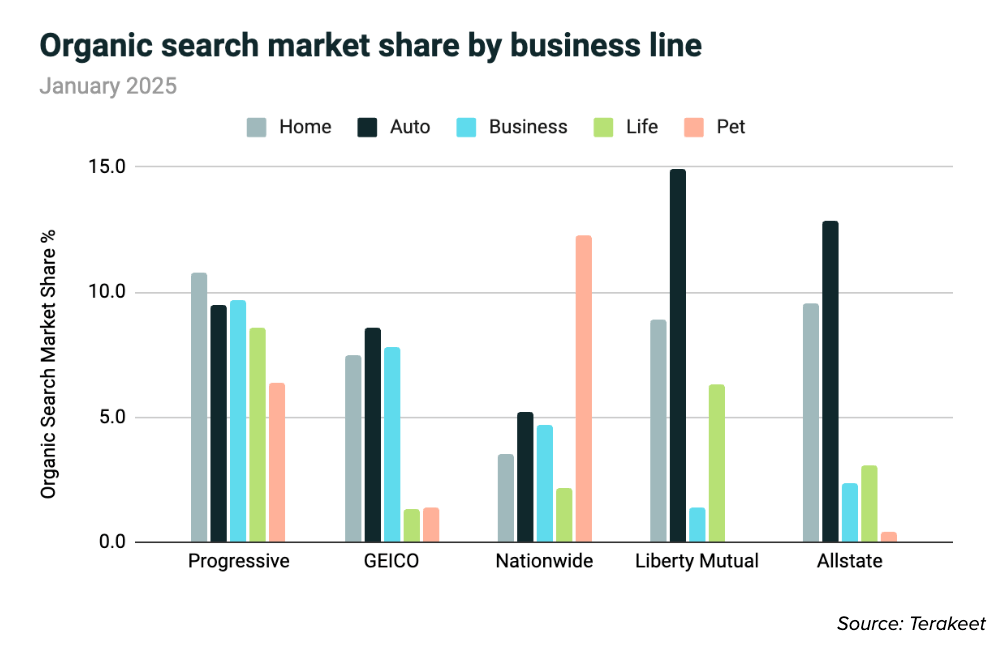

In January 2025, Progressive maintained strong performance across all categories, boosting its overall performance. On the other hand, Liberty Mutual performed the best in auto insurance but fell significantly behind competitors in the business and pet insurance categories.

Surprisingly, State Farm failed to rank in the top 10 for non-brand organic search market share despite being the largest insurance brand by revenue.

This is likely due to leadership prioritizing brand marketing over performance marketing. Although their strategy keeps the brand top of mind, it prevents them from building relationships with undecided consumers.

The Business Value of Winning in Organic Search

Organic search market share isn’t just about visibility. With the right strategy, it also directly impacts policy sales, revenue, and customer acquisition costs (CAC).

We used Terakeet’s patented technology to estimate non-brand organic traffic for all websites across the insurance industry for 40,000 keywords. Then, assuming a 1% conversion rate and the average annual premium costs per insurance category, we determined the total addressable market (TAM) for the segment to be $2.9 billion.

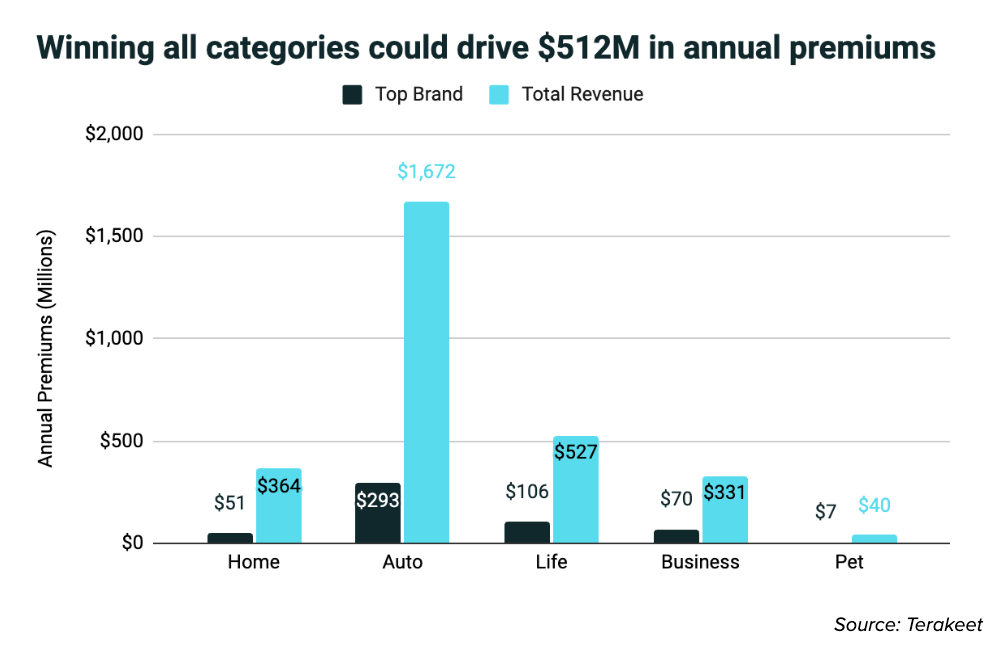

But how much revenue could one brand reasonably expect to capture by winning across all five insurance categories?

We determined the estimated revenue of the top-performing brand in each category. If one brand were to win across all categories, it could generate more than $512 million in net premiums written (NPWs) each year.

Putting Liberty Mutual under the microscope

Since Liberty Mutual saw impressive growth over the past year, let’s look at its performance to understand the revenue-driving potential of non-brand organic search.

Methodology

We used the following formula to calculate revenue from non-brand organic traffic within each line of business:

( Estimated Traffic X Conversion Rate ) X Conversion Value = Revenue

We used the following assumptions in our model:

- Conversion Rate (traffic to policy sale): 1%

- Conversion Values (annual NPW per policy):

- Auto: $2,000

- Home: $1,900

- Life: $2,100

- Business: $1,500

- Pet: $500

To calculate total monthly policies sold, we summed the number of conversions for all lines of business each month. And to calculate total annual premiums written each month (NPW), we summed the annual premium values for all lines of business in a month.

NOTE: We applied the same estimated conversion rates and policy values uniformly across the competitive set throughout this report to compare brand performance.

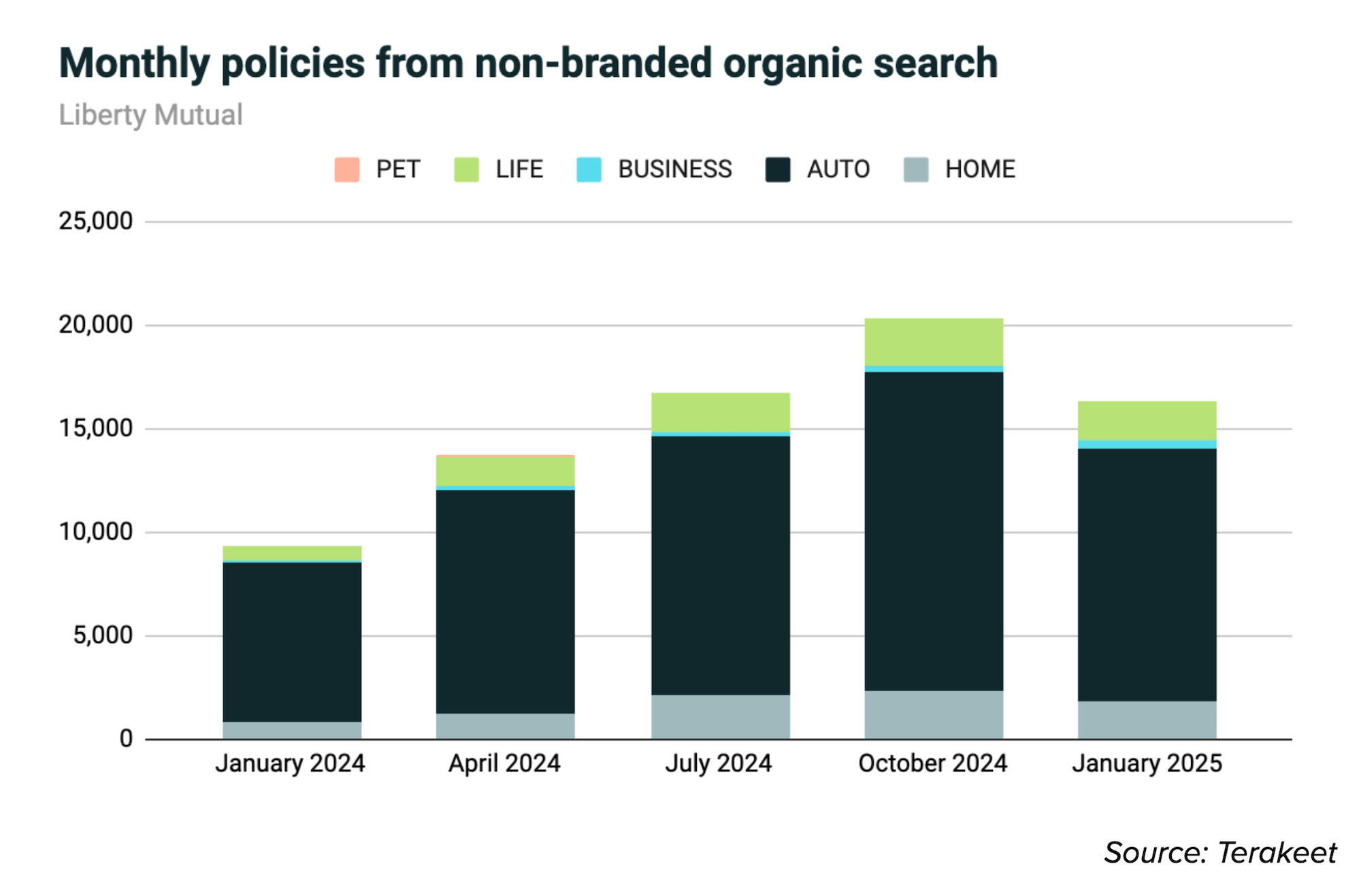

In January 2024, Liberty Mutual earned about 933,000 non-brand organic visits across the five insurance categories we analyzed. Assuming a 1% conversion rate, this traffic would have driven an estimated 9,300 new policies that month.

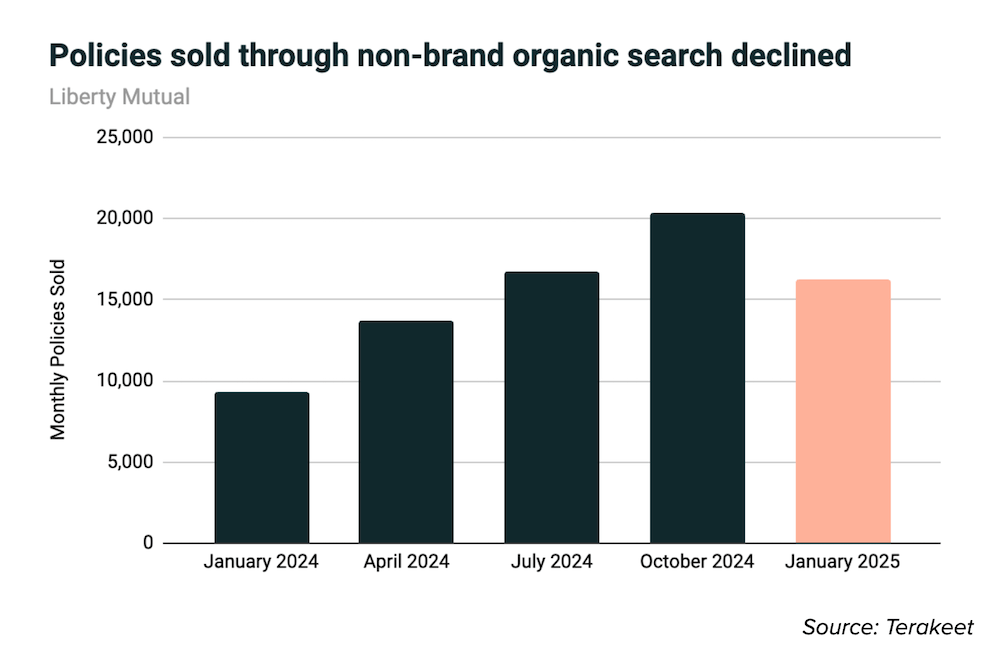

By investing in organic search, Liberty Mutual doubled its monthly sales through the channel by October 2024, selling about 10,000 more policies than it did in January 2024.

If Liberty Mutual had sustained its October traffic levels over the following 12 months, it would have sold 120,000 more policies compared to its lower January 2024 traffic levels.

Those additional policies would have been worth about $264 million annually.

However, at the end of the year, Liberty Mutual lost some of its non-brand organic search market share and traffic to competitors. (The brand is still the market leader but by a slimmer margin.)

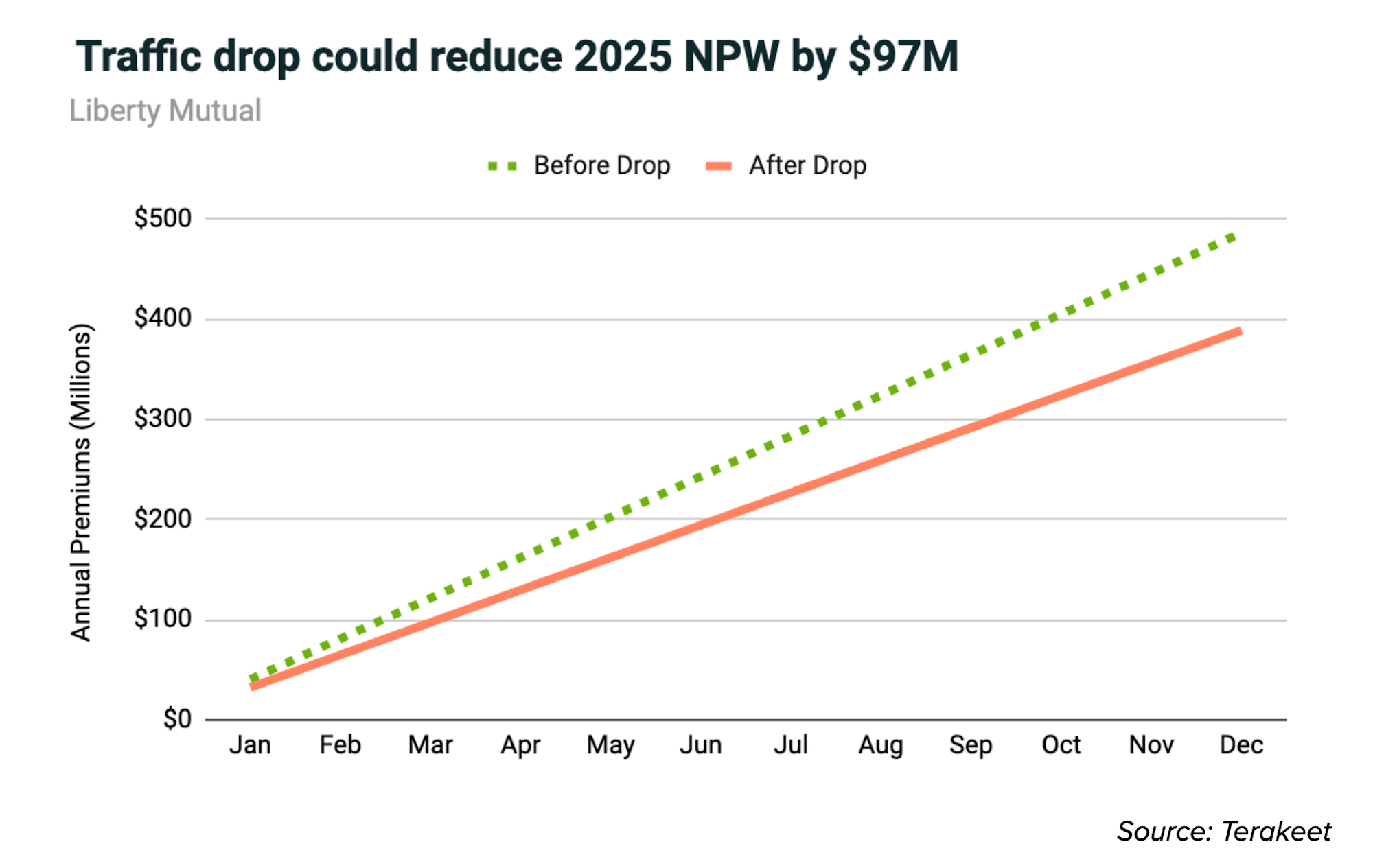

If uncorrected, this dip could compound month over month and cost Liberty Mutual 48,000 policies over the next year, worth up to $97 million in annual premiums (NPW).

And if Liberty Mutual wants to recover the 4.8 million lost annual visits by leveraging PPC, it would have to spend about $111 million based on the average CPC of $23 across all the keywords we analyzed.

That’s the compounding power of organic search.

Insurance executives hold the keys to success

Organic search offers hundreds of millions of dollars in NPW opportunity — a revenue stream that cannot be secured through brand marketing or PPC.

It’s also one of the cheapest ways to acquire new customers, clocking in at 25 cents on the dollar vs PPC and programmatic advertising. Even better, it’s sustainable, building long-term, compounding brand equity.

But to be successful, organic search investments need executive buy-in. Without it, initiatives don’t get prioritized and objectives fall short.

By decoding search behavior, brands can:

- Uncover growth opportunities and competitive weaknesses.

- Develop search-driven content strategies that align with consumer needs.

- Capture high-intent, in-market consumers in moments that matter most.

As competition intensifies in 2025, the companies that dominate non-brand organic search will dictate the future of insurance acquisition. The question isn’t whether they can afford to invest, it’s whether their competitors will beat them to it.