Amazon vs Google: The Battle for Today’s Consumer

Jul 3, 2020|Read time: 12 min.

Key Points

- People search differently in Amazon vs Google, and their behavior drives unique outcomes.

- Google covers the entire customer journey, from original realization of a problem all the way to final purchase.

- Amazon is a conversion machine that capitalizes on customers who already know exactly what they want.

There’s a battle raging online between two search giants: Amazon vs Google.

This battle goes far beyond smart home devices like Google Home and the Amazon Echo. It’s much bigger than voice assistants like Amazon Alexa and Google Assistant. This is a fight for today’s consumer and the search queries they use to make purchases.

And, interestingly, consumers use these two search engines differently.

Comparing Amazon vs Google Searches

Let’s say you hate to vacuum so much that you decided to explore robot vacuums. But, how do you choose the right one?

To answer that question, you turn to Google. You search for “robot vacuums” to learn more about the technology. Then, you narrow your queries down to “best robot vacuum” and “robot vacuum reviews” to compare products.

In response, Google returns endless links to articles, reviews and videos as well as similar questions and answers! Google even provides you with a scrollable “Top 16 Robotic Vacuums” right within the search results.

As you research specific brands and models, Google offers up both organic and paid options for you to explore.

While you’ve been doing all of that Googling, your friend Jake was also interested in a robot vacuum. Jake’s journey, though, took a different course. Jake was already fairly familiar with the magical machines and decided to purchase the iRobot Roomba. Jake wanted his vacuum to ship fast. So, he headed to the platform where his shopping experience would be efficient, reliable, and predictable: Amazon.

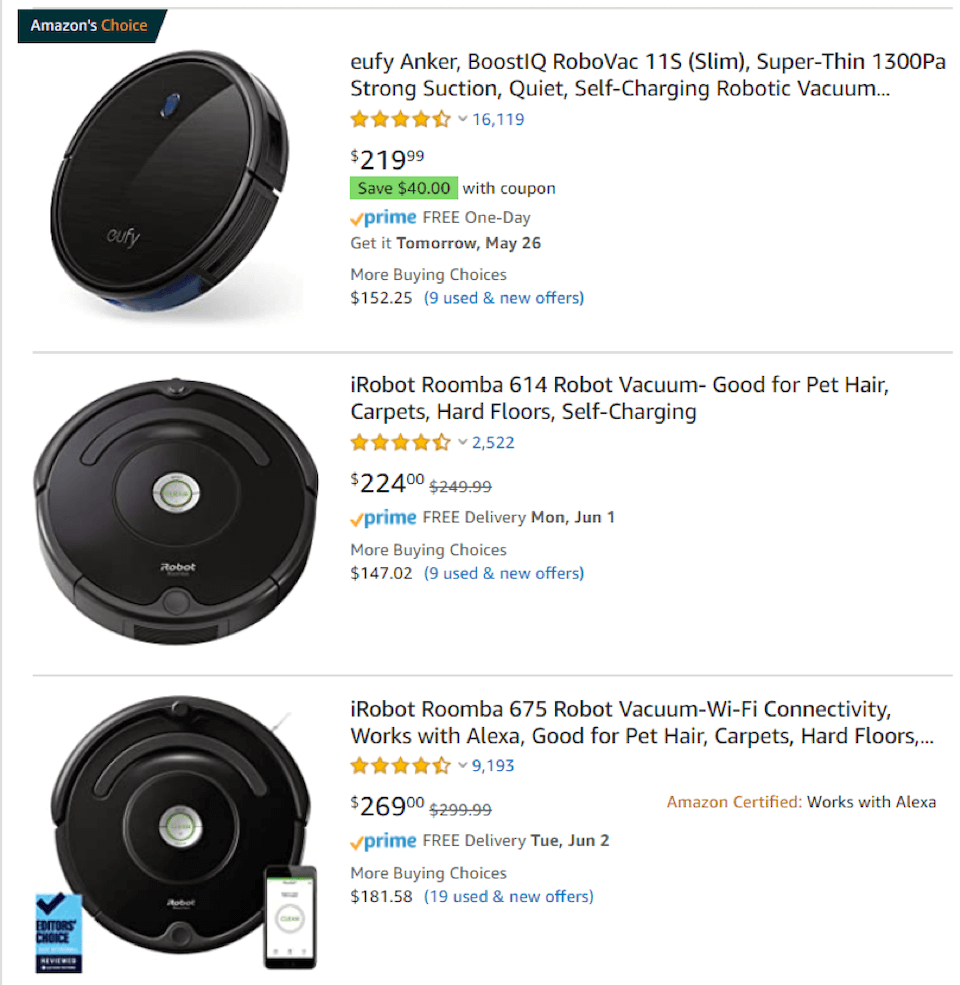

He searched for Roomba and checked the box labeled Prime. There was an array of compelling options in the results, including look-alike vacuums from Amazon’s house brand.

Then, he made his choice and checked out. But, why didn’t Jake search on Google for the Roomba?

Amazon vs Google

Google is a much better search engine, making it the most common first touch point for most of the world’s searches. So why wasn’t it Jake’s?

Well, consider when you would use Google. Maybe you just don’t like to vacuum. Or, perhaps you don’t have time to do it. Or, you might have heard of Roombas and you want to know if they’re worth the hype. In these cases, you consider Google a more reliable provider of unbiased third-party sources.

On the other hand, you will only turn to Amazon after you decide that you want a robot Roomba.

That’s why Google is still the most popular search engine, but Amazon has a 54% market share of product searches. In other words: Amazon, not Google, is the most popular ecommerce search engine in the world.

People sometimes mischaracterize the Amazon vs Google battle as one for widespread search dominance. But it’s not. The two search giants are driven by different profit models and underlying goals. Google profits when people purchase ads. But, that ad real estate is only valuable when people actually use the search engine. That means Google’s search algorithm has one goal: deliver the best results possible for every type of query.

The goal that drives Amazon’s A9 search algorithm, on the other hand? Sales and conversions.

It’s a distinction that creates two very different search experiences between Amazon vs Google. Therefore, you must understand each one to dominate both.

Search intent

The awareness funnel breaks the consumer’s path to purchase into three phases: awareness, consideration, and decision. By translating these phases into three distinct actions – discover, compare, and purchase – we can see how the dichotomy of Amazon vs Google satisfies different user search intents throughout the funnel.

Read more about funnel phases in our post: What The Heck is ToFu, MoFu, BoFu?

Research and discover

In examining Amazon vs Google, Amazon targets a much more narrow band of searchers than Google overall: active shoppers.

A shopper might turn to Amazon to research and discover products (Google Home Max, for example). However, they still need to know exactly what they want in a general sense. Do they want a smart speaker, clothes, a kitchen timer, a white elephant gift, robot vacuum, etc? They’re in the mood to shop and purchase, not sift through every type of content under the sun.

Moreover, the shopper should already know:

- That they care more about convenience and price than quality, or

- That they’re willing to tune out new options and zero in on the brands they recognize and trust.

Nobody shops on Amazon because it’s a bastion of high-quality, well-curated products (arguably, the platform has the opposite reputation).

If you know exactly what you want to find on Amazon’s search engine, you’ll get what you’re looking for. But, how do you narrow down your search? Usually, you go through a much broader research and discovery phase first. That’s where Google has the edge. Google serves content and experiences and not just products. So, even high-funnel searches about customer pain points and interests can introduce searchers to your products.

Compare

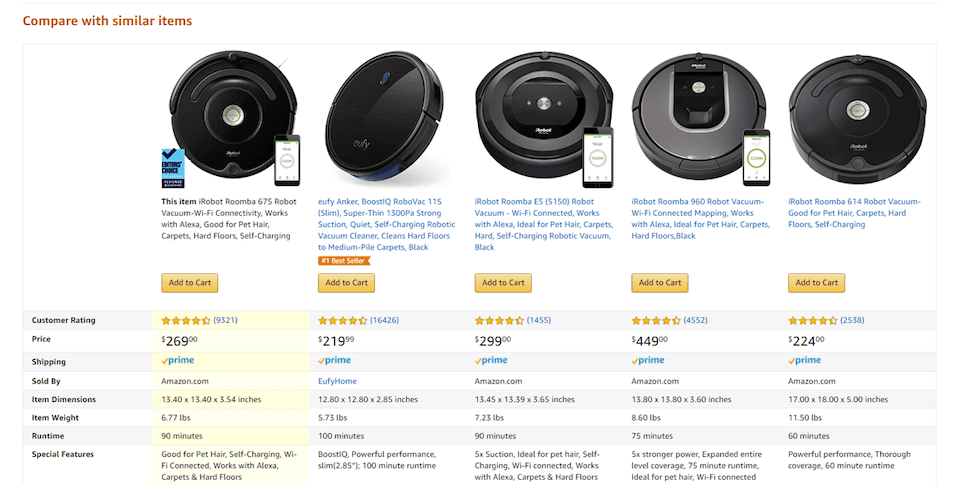

Amazon has a comparison tool featured on the bottom of most product pages:

This tool mostly reformats Amazon’s search listings in a more condensed and user-friendly way. It’s otherwise limited in its functionality. But it’s not useless – as long as you have a narrow enough idea of the product you want.

When you compare Amazon vs Google, you start to notice a theme.

Like Amazon’s product discovery features, its compare feature is geared toward low-funnel shoppers who almost know exactly what they want. Or they do know what they want, but they are looking for final validation. For that audience, a quick-and-dirty comparison tool is a bit more effective than Google’s organic listings. (However, a Google user could still navigate to Google Shopping to narrow their field of results to shoppable products. Once there, they can use similar comparison tools to filter and sort).

Amazon shoppers can also read product reviews. However, they can only read reviews on each product page and need to connect the dots from there.

When a shopper uses Google organic search to compare options, they’re often slightly higher in the funnel. They’ve decided what product they want, and now they need to decide which brand sells the best one. They care less about price than value or fit at this stage. Which product is the best value for their money, or, which one checks the most boxes? To determine this, they’ll seek outside opinions: reviews, blog posts, articles, product roundups, and more.

It’s also highly likely that the user will gravitate toward unbiased third-party content. In this arena, Google has the edge. Google’s work to provide useful, unbiased content without a purchase-driven agenda is a better fit for comparative shoppers than Amazon.

Purchase

Last, we get to the part of the funnel where Amazon has the edge over Google: the purchase phase. Amazon’s path to conversion is incredibly clear and easy. In fact, a person could probably find the product they want and check out in under 60 seconds. Moreover, using Prime controls variables like shipping fees, delivery times, product returns, order cancellations and more. Those are all questions you won’t have to ask on a platform where the answer is the same every time.

On Google, there are more steps to purchase. At the very least, you’ll search for the product you want, visit the ecommerce site, add the item to your cart, and enter your information to check out. You might go through additional steps like hunting down the answers to those shipping and return questions you don’t have to ask on Amazon. And your path might be far more complicated than that; each ecommerce site offers a unique journey.

That said, there are a number of reasons people might turn to Google to begin their purchase instead of Amazon, starting with the biggest one: not every merchant or brand uses the Amazon platform to sell their products. This is an especially important consideration for brand-loyal shoppers in deciding where to go — Amazon vs Google.

Make Connections that Matter

Uncover what your customers are looking for in real time and meet their needs with valuable content.

Factors to consider

Branding reputation and positioning

People shop on Amazon for convenience and affordable prices, two qualities you don’t necessarily associate with high-end brands. That’s why there’s mounting evidence that for shoppers, Google is the preferred platform for high-end brands while Amazon is preferred for mid- or low-market brands.

Brand reputation is also more important during comparative or awareness-driven Google searches, a stage when the brand’s voice and values can play a huge role in turning a customer’s head.

By the time the user hits Amazon, they’ve already decided on a brand they like or don’t have a preference. Plus, a brand’s ability to market in their own voice, tone, and personality are far broader through websites and content that could appear in the Google SERPs.

Keyword research

People search for different keywords when they’re in each stage of the purchase funnel, and keyword searches on Amazon reflect the purchase stage: they’re highly specific. They’ll often include the exact product and brand name, and may include additional qualities or attributes.

Google attracts keyword searches across every funnel stage, opening your opportunities up to high-funnel, awareness-driven searches as well as highly specific long-tail keywords lower in the funnel. The number of keywords you can target is theoretically unlimited, as you can produce a theoretically unlimited amount of optimized content. This isn’t the case on Amazon, where the amount of content you produce is limited to the number of products you sell.

For both search engines in the Amazon vs Google battle for today’s consumer, keyword relevance is a critical ranking factor.

We explain how to do intent-driven keyword research here.

Search volume

As the world’s largest search engine, the volume of searches that take place on Google dwarfs Amazon. However, recall that 54% of product searches happen on Amazon. Both search engines are a critical touch point for millions of shoppers.

Another reason Amazon’s search volume is naturally lower than Google’s is because search volumes tend to decrease as users move down the funnel. By the time the user gets to the decision phase, many of the high-funnel counterparts have already moved on to other queries.

Reviews

While product reviews are a factor in rankings and conversions on both Google and Amazon, they carry extra weight on Amazon because Amazon is working with a less complex algorithm. Simply put, Amazon really only has two major questions to answer: 1) Is this the product the user wants? And 2) Is it a good product? Relevant keywords, CTR, and conversion rates answer the first question; online reviews help answer the second.

Conversion funnels

According to one study, Amazon converts 6X higher than the top ten retail sites in the U.S. The platform also converts at a much higher rate than Google. This is largely because of where buyers are in the conversion funnel, as well as the searcher’s mindset. Google caters to many more types of searches, creating many more opportunities for customer touch points along the purchase journey.

People convert well on Amazon because they turn to Amazon when they’re ready to convert. This isn’t always true on Google or even an ecommerce site, where you can leverage blog posts, look books, UGC, and other content to build critical brand awareness and education about your products.

If you want boost transactions, understand conversion rate optimization (CRO).

Consumer Connections Newsletter

Exclusive insights, trends, and actionable brand strategy, direct to your inbox.

The experience

Today’s customer journey involves making several searches and visiting numerous pages before purchasing a product. This happens not during one session, but across multiple sessions and devices, and often over time. By comparison, the Amazon search experience is more direct and tactical, leading to a faster path to purchase.

That doesn’t mean Amazon is your golden ticket to sales, though. Without that long, meandering discovery phase, there is no purchase phase – there would be nobody to care about the brand or products in the first place.

Effective strategies for retailers and brands

Optimize for both Amazon and Google

The bottom line is, shoppers switch between Google and Amazon to meet different needs. Both search engines are an invaluable part of an omnichannel strategy.

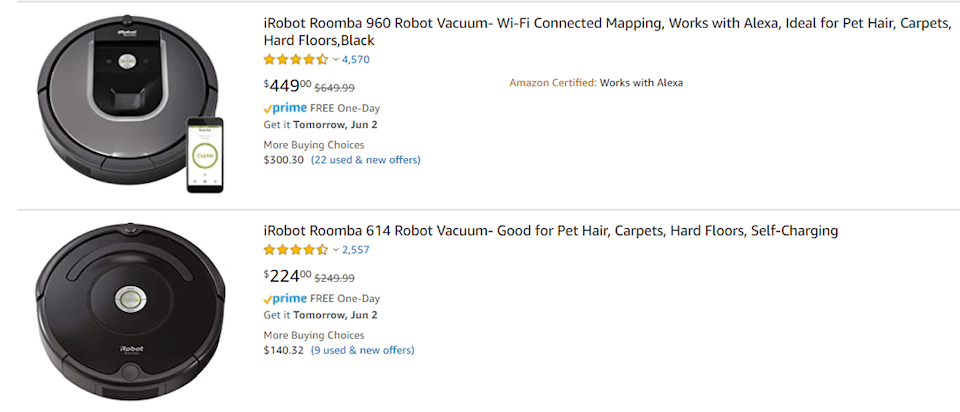

Target keywords throughout the sales funnel for Google — think ToFu MoFu BoFu. On Amazon, focus on low-funnel keywords. Keywords are generally straightforward on Amazon and don’t necessitate the same amount of keyword research as Google; the brand and product name along with specific product attributes is almost always the best option. Take a look at the keywords in two different Roomba titles:

Each title begins with the brand name and the specific model because some searchers already know exactly what they want. But, Roomba knows that most people don’t know which vacuum they want down to the model. So, they include the keyword “robot vacuum” along with the specific attributes a shopper might seek. If the shopper searches for “robot vacuum for pet hair,” for example, these products would come up.

If you have numerous very similar products, write titles that perform double-duty and differentiate the products at a glance. In the example above, users can extract from the title which Roomba is wifi-connected and works with Alexa. You’ll increase your conversion rate if the search results explain how the product fits a customer’s needs.

Because Amazon search results deliver products exclusively, and not products or content, you have an opportunity to rank for keywords that would not meet the search intent of a Googler.

Consider the search “robot vacuum.” If someone searches for this on Amazon, a Roomba listing would fit the bill. What’s more, there are several different types of Amazon ads you can use to further boost your visibility on that search engine.

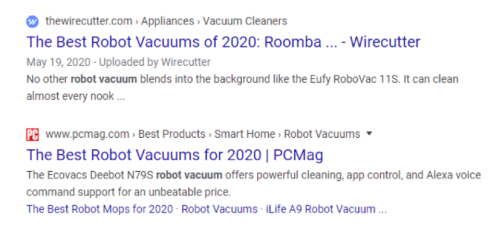

Google, on the other hand, has determined that when someone searches for “robot vacuum,” they’re looking for information – not products. So, Google’s top results for the keyword look like this:

Dominate the Google organic SERPs

When it comes to your ecommerce marketing strategy, one area where you can double your winnings is the Google SERP. Whether your customers use desktop computers or smartphones; Android or Apple; text or voice commands, they’ll likely turn to Google. So, instead of asking “Where should I focus, Amazon vs Google?”, ask the question, “How can I own as much SERP real estate as possible?” (just don’t forget to say “hey Google” before you ask).

Amazon product pages usually rank quite well on Google. That gives you a chance to take up additional room in the SERPs by optimizing your ecommerce product page on your website as well as your Amazon page.

Next optimize your category pages, create irresistible content, produce amazing videos, and add Google Shopping Feeds, video, social media and PPC to the mix. Conduct an outreach campaign to get publications and influencers talking about you. Claim listings and solicit positive reviews. Before you know it, you’ll be looking at near-total SERP domination for a number of high-value keywords. And that’s how you win the war.