Beauty Industry: Cosmetic Market Share, Trends, and Statistics

Jul 15, 2021|Read time: 15 min.

Key Points

- Total global beauty industry spending in 2020 was $483 billion, and the annual total is expected to top $716 billion by 2025.

- Historically, the lion’s share of beauty products have been purchased in brick-and-mortar stores, but that’s changing rapidly, with online sales projected to make up 48% of the total by 2023.

- Surprisingly, publishers and informational sites significantly outperform beauty brands and beauty retailers when it comes to Google organic search.

2020 was a rollercoaster year for the beauty industry. Big brands with brick-and-mortar locations were hit hard by COVID-19 lockdowns, forcing marketers to come up with new ways to sell to customers. As a result, many ecommerce and direct-to-consumer (DTC) brands saw an increase in sales due to the pandemic because millions of people had to shop almost exclusively online.

Download Terakeet’s Beauty Industry Report to see which brands are winning (and losing) in Google organic search market share.

What will the next few years look like for the beauty industry? Will consumers return to stores in the same numbers, or will they continue to buy online? Terakeet analyzed current trends and search data with our proprietary software, Carina, to extract some key marketing insights. View more insights in the beauty segment of our retail industry page.

Read on for a high-level look at the beauty industry, trends that matter, and cosmetics marketing strategies that will create the most success.

Beauty industry statistics, market share, and worth

The beauty industry is a behemoth that shows no signs of slowing in growth. How much is the beauty industry worth? Total global cosmetic sales in 2020 was a whopping $483 billion. With an annual growth rate of 4.75%, total revenue is expected to top $716 billion by 2025.

The Asia Pacific region, including China, has the biggest cosmetics market share, at 46%, followed by North America at 24%, and Western Europe at 18%. By geography, Asia Pacific and North America dominate, accounting for more than 70% of the total market size combined.

In the United States, beauty market share by revenue is segmented by the following beauty categories.

| Category | Market Share |

|---|---|

| Hair Care | 24% |

| Skin Care | 23.7% |

| Cosmetics | 14.6% |

| Perfumes & Colognes | 9.5% |

| Deodorants, Personal Care Products, Feminine | 8.5% |

| Oral Hygiene | 5.6% |

| Other | 14.1% |

Beauty industry growth

Online sales will make up 48% of all beauty sales by 2023

StatistaThe online channel for beauty in the U.S. grew by 5.6% in 2020

StatistaThe offline channel for beauty contracted by 1.2% in 2020

StatistaLike many other industries, the beauty industry was rocked by the COVID-19 pandemic.

Historically, the lion’s share of beauty products have been purchased in-store, such as department stores, drugstores, and specialty shops.

However, that’s changing rapidly, with online sales projected to make up 48% of the total by 2023. This growth in online purchasing was already occurring prior to 2020, and the COVID-19 global pandemic greatly accelerated it. Overall, the online channel for beauty in the U.S. grew by 5.6% in 2020, whereas the offline channel contracted by 1.2%, according to Statista.

But, why is the beauty industry growing? Moreover, how are online sellers capturing market share from brick-and-mortar retailers? Let’s look at some key drivers.

DIY beauty

With many salons closed for months in 2020, there was a significant rise in demand for DIY beauty products, such as peels, masks, and waxing kits. This trend is expected to grow, even as salons and spas reopen.

Clean beauty

Clean beauty is another business growth area within the beauty industry to watch. However, it’s hard to pin down an exact definition for clean beauty. In fact, it can range from natural product development, to cruelty-free products, to products created with sustainability in mind.

Consumers are wary of using products that contain harsh chemicals. That’s why the global market value of natural cosmetics is projected to hit $54B by 2027.

Companies that sell clean beauty products can expect to see a surge in demand moving forward.

Inclusivity

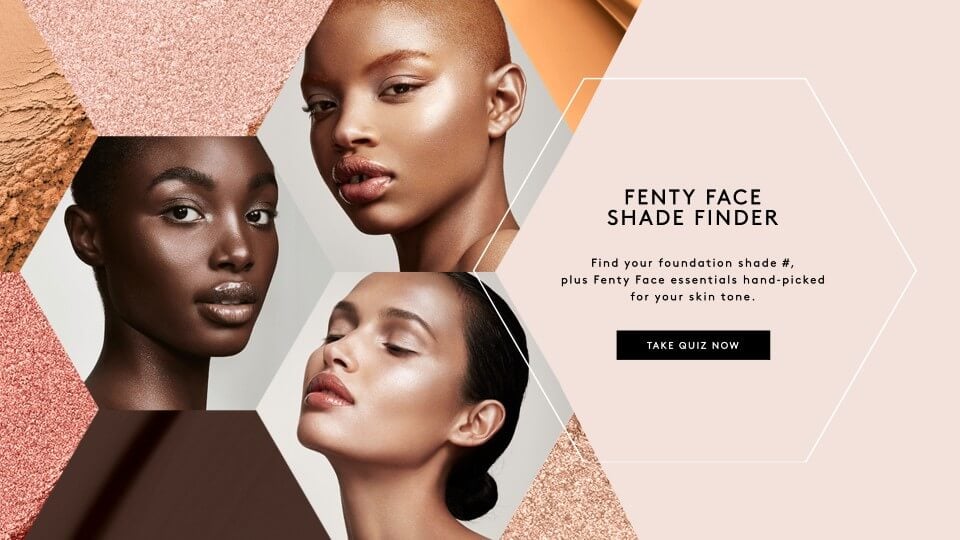

Inclusivity is also playing an increasingly important role in the beauty industry. Historically, many products allowed for only a limited range of skin tones. But, in recent years, cosmetic brands have become more inclusive, dramatically expanding color options.

For example, Fenty features a face shade finder on its website and enables site visitors to choose from 40 different shades of foundation.

Beauty industry analysis: Google organic market research

Consumer behavior has shifted. As more people research and purchase beauty products online, it’s critically important for brands in the cosmetics industry to seize the growing opportunity of organic search.

However, an analysis of Google organic search market share in the beauty industry reveals a surprising reality.

Beauty industry report: organic market share

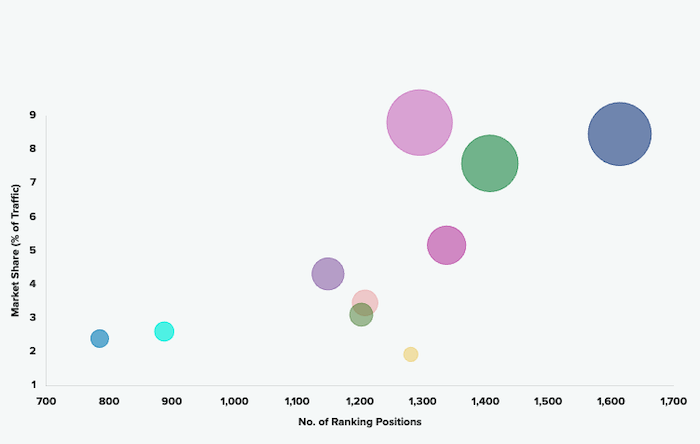

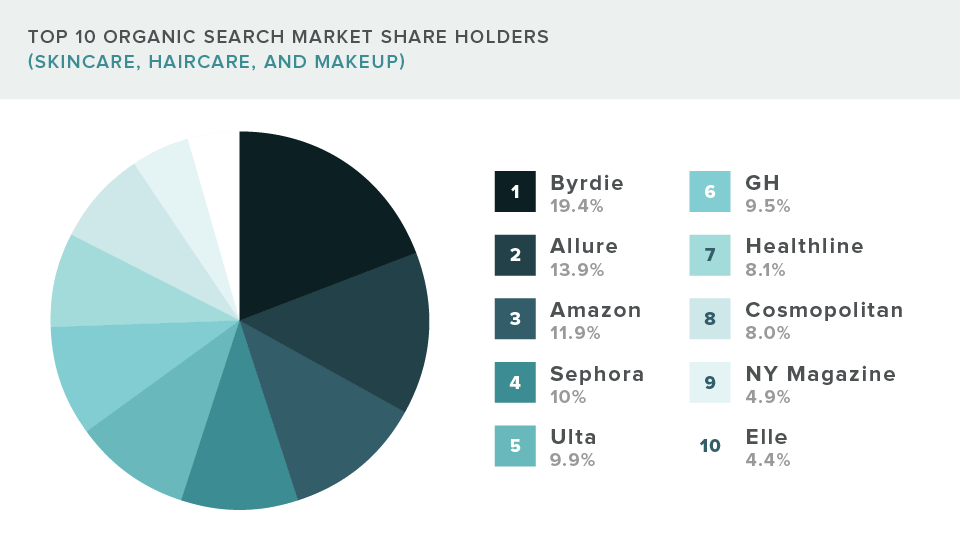

Terakeet analyzed 3,168 high-value, non-branded beauty industry search queries, which account for 112.7 million annual Google searches in the U.S. These keywords span three vital markets, including skincare, makeup, and hair care.

The truth is, online publishers and informational sites significantly outperform established beauty brands like L’Oréal, Procter & Gamble, and Estée Lauder Companies.

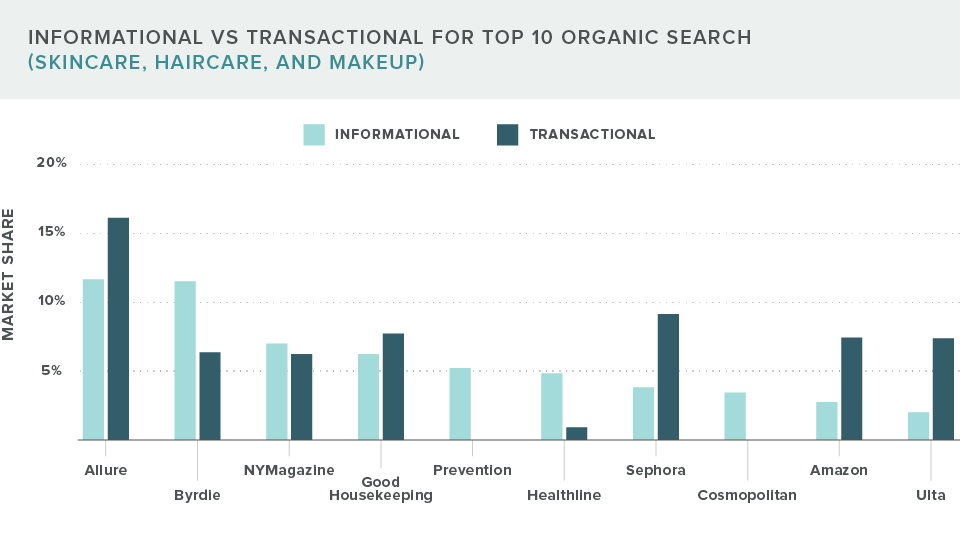

When we compared informational vs transactional searches, online publishers really pulled ahead. The top six market share holders for informational searches are publications. Only three of the top ten are beauty retailers. And even among more product-focused searches, informational websites like Allure, Good Housekeeping, and Byrdie performed well.

Organic search market share: Skincare

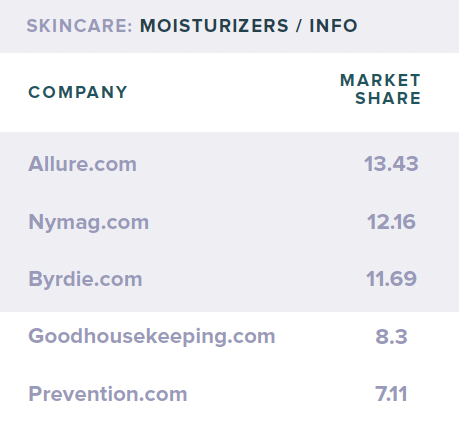

When we zoom in on the skincare market (which includes lotions, creams, moisturizers, anti-aging serums, and cleansers), the top four performers are publishers rather than skincare brands. Furthermore, 17 of the top 22 performers are publishers, capturing 62.3% organic market share.

And this isn’t just the case for informational keywords. Traditional brands and beauty retailers are losing ground on product-related searches as well, when consumers are actively looking to purchase.

Terakeet analyzed 915 of the top keywords in the skincare market, representing 26.52 million annual U.S. searches. Four of the top five skincare market share holders are online publishers. And the top five websites hold 40% of the total organic search market share.

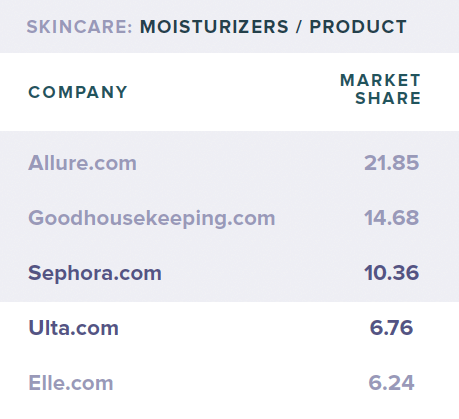

When we zoom in to examine 109 product-related keywords within the Skincare market (which represent 4.64 million annual Google searches in the U.S.), six of the top 10 Google search results are publishers or blogs.

Think about that. Sixty percent of the Google page one rankings for product keywords are for websites that don’t even sell skincare products.

Allure and Byrdie rank first and second, and their websites attract between 60 and 80 million organic search visitors overall each year. For more, read our article, How Byrdie Toppled Billion Dollar Beauty Brands (Without Ads).

Why do they outrank the biggest beauty brands? Because they invest in high-value content that’s relevant to consumers. In fact, Dotdash, the parent company of Byrdie, invested more than $50 million into content over a three-year period across their publishing portfolio.

In addition to great content and SEO, these publishers also have strict editorial standards and publish expert advice, including reviews, hair, product, and makeup tutorials.

Bottom line, beauty brands are missing out on a major opportunity when it comes to organic search traffic.

Download our beauty industry report below for more beauty industry insights.

Beauty Market Report

See which beauty brands are winning, and losing, in the race for market share.

Organic market share of top consumer brands in the beauty industry

So, where do some of the top beauty brands and retailers rank in terms of organic search market share?

Beauty brands such as Unilever, Estée Lauder, L’Oréal, Glossier, and Clinique are nearly invisible in the non-branded organic search landscape across skincare, makeup, and hair care. They simply lack the SEO strategy and long-form content needed to compete effectively in Google.

Brands like Sephora and Ulta, in comparison, perform much better than the traditional beauty brands in organic search. However, they still lag behind many publishers, blogs, and even health-related websites, depending on the type of keyword.

For example, here’s the top five ranked websites in the moisturizers sector of the beauty industry (informational searches vs product searches).

Informational Queries

Transactional Queries

Organic market share of Amazon

Amazon’s dominance in ecommerce SEO is, of course, well known. However, even Amazon has challenges competing in various beauty market sectors.

Across the skincare queries that Terakeet examined, Amazon ranked eighth in organic market share. In makeup, Amazon ranked slightly better in position five. Hair care products is where Amazon performed best in Google, with the second highest market share.

Consumer Connections Newsletter

Exclusive insights, trends, and actionable brand strategy, direct to your inbox.

Beauty industry digital marketing trends

With an ever-increasing percentage of the buyer’s journey happening online, beauty brands must have a clear digital marketing plan. Here are some of the most important online beauty industry marketing trends to watch.

Search engine optimization (SEO)

You can see why SEO is incredibly important for beauty brands. It goes far beyond making sure ecommerce pages are optimized, although that certainly matters. An effective SEO strategy allows companies to connect with and serve more people at each stage of the purchase funnel.

If beauty companies publish content around informational keywords and optimize the on-page elements, then they can more effectively reach customers who are in the early stages of the buying process and nurture the relationships until prospects are ready to purchase. Even informational content in the middle of the funnel can grow brand awareness with new prospective customers.

Content marketing strategy

In the highly competitive B2C beauty industry, an effective content strategy can help brands differentiate from the competition. For instance, creating and promoting engaging content across multiple channels helps beauty companies increase brand awareness and create authentic relationships within their audience.

But, what is content marketing? The definition is rather broad, and means the publication and distribution of content across all platforms. So, whereas content strategy is the high-level plan, content marketing is how you get it in front of your audience. Here are just a handful of content marketing examples to consider for your strategy.

- Blogging and vlogging

- Social media

- Video

- Interactive tools/apps (like the Fenty shade finder)

- Podcasts

- User generated content (UGC)

When it comes to beauty content marketing, the sky’s the limit. But, make sure you include plenty of visuals, whether in the form of graphics, photos, or videos.

Search engine marketing (SEM)

Investing in SEM allows beauty brands to show up at the top of search results for important keywords. Paid search is effective when you need to appear in the Google search results quickly or for specific short-term campaigns.

This digital marketing channel is especially effective when combined with SEO. When done effectively, it enables brands to own both the top sponsored and organic spots in search results, which translates into a significant amount of site traffic.

Of course, depending on the competitiveness of the keyword, companies may have to pay a significant amount per click in order to earn the top sponsored spot. Plus, keep in mind that roughly 70% of the clicks in Google go to the organic listings. And another problem with SEM is that once you stop spending, your results literally go to zero immediately. Over the long term, SEO is better than PPC, providing both compounded returns and a much higher ROI.

Read our deep dive into SEO vs SEM here for a more thorough comparison.

Video marketing

The highly visual nature of the beauty industry makes video marketing a critical strategy for brands. Videos give people the opportunity to see a product in action, which is particularly important for cosmetics products. A successful video marketing strategy should include a variety of video types, including everything from short videos on Instagram and TikTok, to longer videos on YouTube and blogs.

You’ll also need to optimize your video for search so it shows up for the right keywords!

The videos should also be a mix of promotional and informational, with the emphasis falling on informational. Tutorials, comparisons, and behind-the-scenes are simple, yet effective ways to build rapport with an audience. As a result, you’ll create the sort of lasting relationship that often ultimately leads to a purchase.

Beauty influencers

Perhaps more than any other industry, the beauty industry is associated with influencer marketing. And it still remains an important and effective marketing vehicle for makeup brands and other cosmetics retailers.

- Certain brands will benefit by working with mega influencers and entrepreneurs like Huda Kattan, Nyane Lebajoa, or James Charles.

- Often, though, lesser-known beauty experts who have a more dedicated, loyal, and sincere following deliver better results for brands. Even though their audience is smaller, they’ve built a more trusted community and therefore have more actual influence.

- One powerful trend in influencer marketing is brands building an influencer team. This emphasizes relationships and long-term beauty marketing campaigns rather than superficial one-off transactions.

- In addition, body positivity is a strong trend in the industry. This has led more brands to partner with a broader range of influencers. For example, Dove recently named Lizzo a new brand ambassador.

Social media

Social media marketing is essential for beauty companies, but choosing the best platform depends on the brand’s target audience.

Companies that sell primarily to Millennials and Gen Z will want to focus on Instagram, TikTok, Snapchat, YouTube, and Pinterest (to a degree). Brands targeting older demographics will want to focus more on Facebook and Pinterest.

Beauty brands are increasingly learning how to use social media channels for actual sales. L’Oréal has been a pioneer in social commerce through the years, including livestream shopping. In 2020 the company invested in the social commerce software company, Replika Software, in order to increase ecommerce sales and peer-to-peer selling.

“

To compete online, beauty brands must develop new, innovative ways to capitalize on social channels.

TERAKEET

Virtual experiences

Another one of the biggest beauty industry trends is virtual experiences. These are a relatively new marketing strategy that work especially well for the cosmetics industry where personalization is important. Some examples of amazing digital customer experiences include:

- Livestream beauty tutorials

- Online courses taught by experts

- Virtual consultations

- Augmented reality apps that allow customers to virtually try on new products

For example, Ulta’s Glam Lab lets customers see what they’ll look like using different types of color cosmetics like mascara and eyeshadows, as well as with different hair color or eyelashes. Since the COVID-19 pandemic, use of the tool has exploded, with millions using it to virtually test different products.

While this type of content marketing is relatively new, it’s going to be increasingly important this year and coming years.

Email marketing

Email marketing is a highly effective ecommerce strategy for beauty marketing teams. It’s especially important for ecommerce and direct to consumer (DTC) brands that don’t have physical retail locations.

Email marketing allows brands to connect directly with customers in ways other marketing strategies can’t. It can be used to nurture relationships, promote special offers, recover abandoned carts, highlight newly published content, and more. It’s one of the most effective means of building brand love.

Based on customer preferences, demographics, and behavior, email marketing also allows brands to deliver a more personalized experience to customers. As a result, you’ll create a stronger bond between your brand and your customers.

Word of mouth (WOM)

Few forms of brand marketing are more effective than Word of Mouth (WOM). Nielsen notes that 92% of people trust recommendations made by friends or family more than any other advertising.

How can marketing managers create WOM buzz around their products? The starting place is offering customers a superior buying experience, including both the products and themselves and the purchasing process. If customers don’t have a superior experience, they’re not likely to spread the word to friends or on social media.

With the solid foundation of an outstanding experience, companies can start creating other ways to get people talking. Some options include:

- Creating a referral program that rewards brand ambassadors

- Highlighting customer reviews on their website

- Sending products to influencers without asking anything in return

- Rallying around a social cause, much like TOMS did by supplying shoes to those in need

- Creating viral content that people want to share

Communities

Building vibrant online communities is an effective way to foster brand loyalty and increase engagement among customers. Individuals can share tips and tricks with one another, help solve problems, and make recommendations based on their personal experience.

Brand representatives can also interact with group members, answering questions, addressing any problems that arise, and even getting feedback on various topics.

Sephora is a good example, with its thriving Beauty Insider Community. Here, you can ask questions, get tips, join challenges, receive recommendations, etc. By combining its Beauty Board, Beauty Talk, and Ratings and Reviews, Sephora has nurtured a cohesive and immersive environment for its customers.

Sephora further deepens the engagement by offering Groups of like-minded individuals. For example, the Group “Skincare Aware” within the Beauty Insider Community has more than 460,000 members with more than 16,000 unique conversation threads.

Branded communities are the wave of the future, and smart beauty brands will make them a priority.

Content Strategy Playbook

The Fortune 500 CMO’s guide to content strategy.

The Future of the beauty industry

Although COVID-19 shifted consumer shopping behavior patterns within the beauty industry, there’s no doubt that the industry will continue its current growth trajectory. Though customer demand and preferences will evolve as beauty standards do, the fundamental human desire to be attractive and achieve wellness through self-care will remain the same.

To thrive, brands must be hyper-aware of current beauty trends and shape their growth marketing strategies to align with the times. Legacy brands must adapt to these changes or they risk losing market share to startups utilizing different business models. Similarly, they need to keep pace with effective marketing strategies such as more advanced beauty influencer marketing and branded communities.

With ever-increasing online sales, digital marketing is increasing in importance to beauty brands. Publishers are dominating organically online in the beauty space, and beauty brands and retailers should take note and invest more in SEO and content in order to capitalize on the millions of online searches being conducted each month.

There are ample opportunities to seize greater market share. Is your brand doing what it’s going to take to win in the future?